UNLOCK

Guide to GTM Fit

Introduction

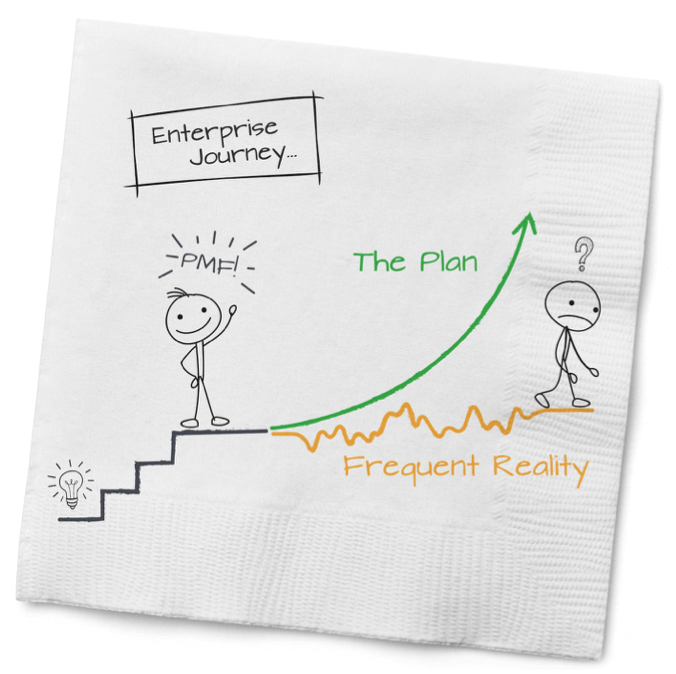

When many enterprise startups get to PMF, they feel they’re ready to take off. “We have product-market fit! Let’s grow! Hire sales! Invest in marketing! Spend!”

The unfortunate frequent reality kicks in. Instead of sales taking off, sales just bump along. The number of new customers grows sporadically, painfully disproportionate to the rapid increase in sales and marketing.

Many enterprise startups get to PMF but don’t achieve growth and acceleration.

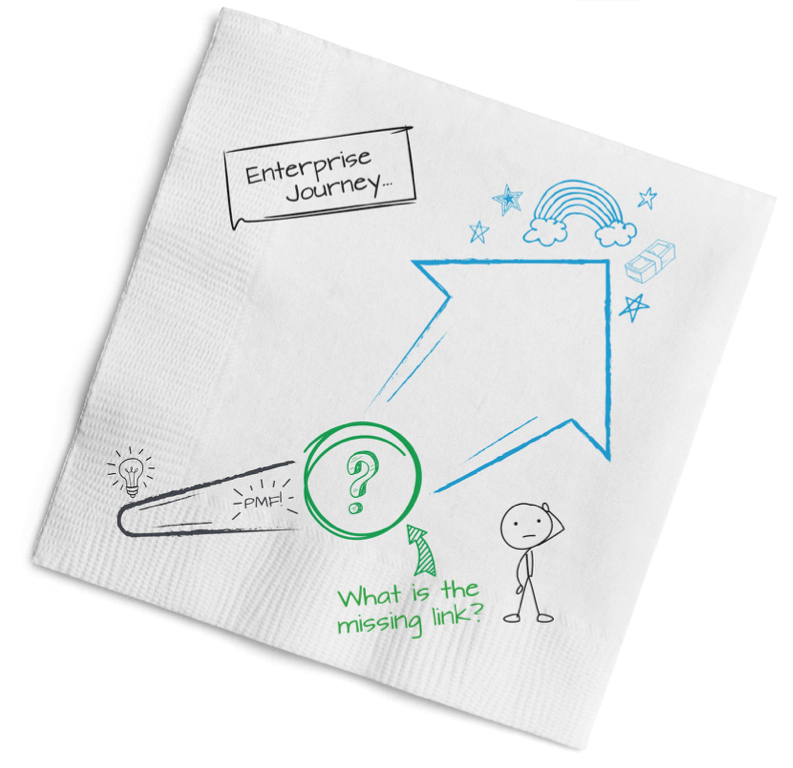

Why? Because there’s a “missing link” between PMF and accelerated growth for the enterprise startup journey.

The missing link is something we call Go-To-Market Fit, or GTM Fit.

UNLOCK is a GTM Fit Guide

UNLOCK is a comprehensive GTM Fit Guide based on Chapter 3 (Go-To-Market Fit) from our first book, Building the Enterprise Startup: The Company Journey.

In The Company Journey, we coined the term “Go-to-Market Fit.” The response to the book was incredible, and notes from readers showed us we had many questions left to answer. Many responded: “We appreciate the insight of GTM Fit… but how do we find it?” So, we decided to mine the experiences of our portfolio companies to share a repeatable “recipe” for achieving GTM Fit and unlocking growth.

Brief Overview of UNLOCK

UNLOCK outlines our 4-step path to finding GTM Fit and unlocking growth. We’ve added 100+ pages of new content, real-life examples, interviews and resources to help you find GTM Fit to unlock growth. If you’re new to the subject, we recommend reading the sections in order. However, if you’re looking to dive deep into some sections and skim others, you can easily skip around using the table of contents on the left.

Our approach was to provide as many real-world examples and applications as possible. The GTM Tip, Challenge, and Common Mistake boxes go in depth on issues you’re likely to encounter on the path to GTM Fit. We’ve also provided many diagrams and links to downloadable resources to help you on your journey. The idea is that you can dive into as much detail or little as you want.

With that in mind, here’s a short outline of the modules that lie ahead:

In GTM Fit Basics, we explain what GTM Fit is, when to look for it, and why it matters for unlocking growth.

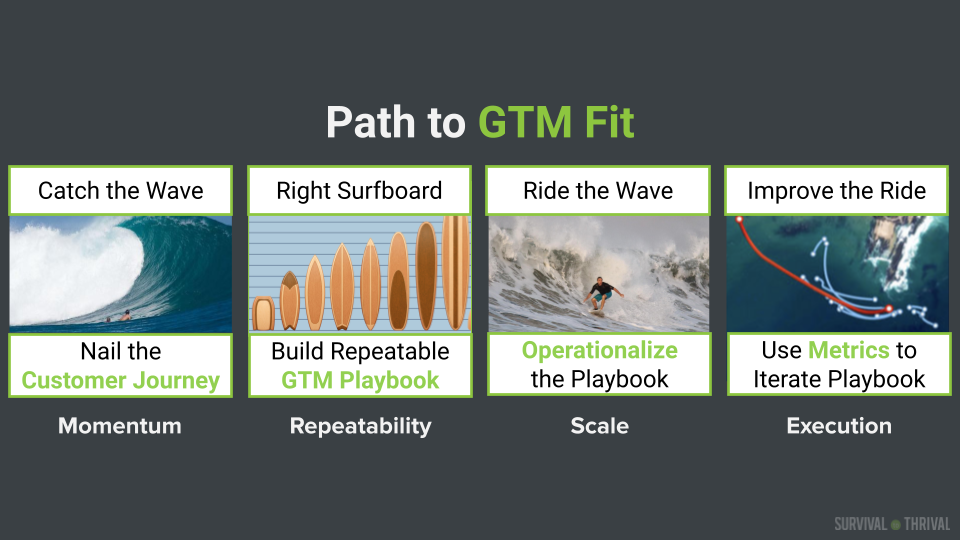

Next, we dive into the 4 steps to unlock growth. We see GTM Fit as the transition from paddling to surfing. Paddling is painful. Surfers expend a tremendous amount of energy paddling for relatively little progress. Without GTM Fit, companies burn a tremendous amount of cash for minimal growth. Once you find GTM Fit, you’re no longer paddling for your life. It’s pure momentum.

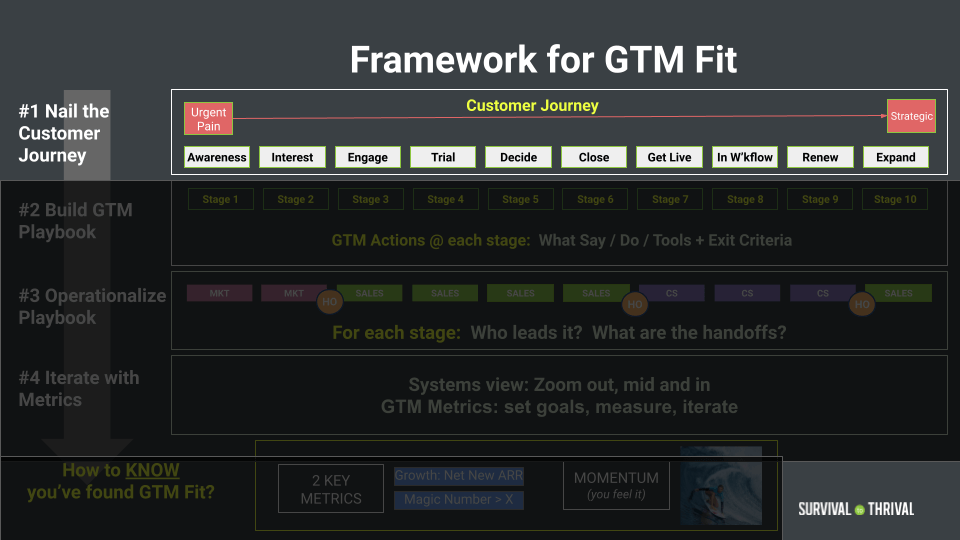

Our 4-step path is designed to take you from paddling to surfing:

Step 1 is Catch the Wave: Nail Customer Journey (CJ). The CJ is the backbone of your entire Go-To-Market. Everything else is built on top of it. The CJ starts with the Urgent Pain and ends when your company becomes strategic to the customer. To find out how to win first customers, we interviewed two first customers (Barclays MD of Cyber Risk JJ Juergensen and Medallia CIO Ashwin Ballal), who illuminated the fundamental difference between the customer and the founder: risk asymmetry.

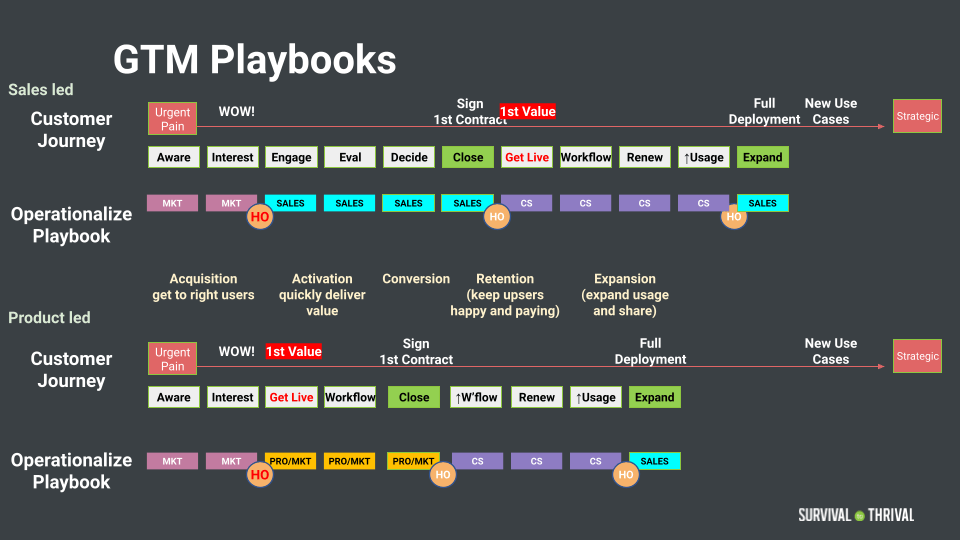

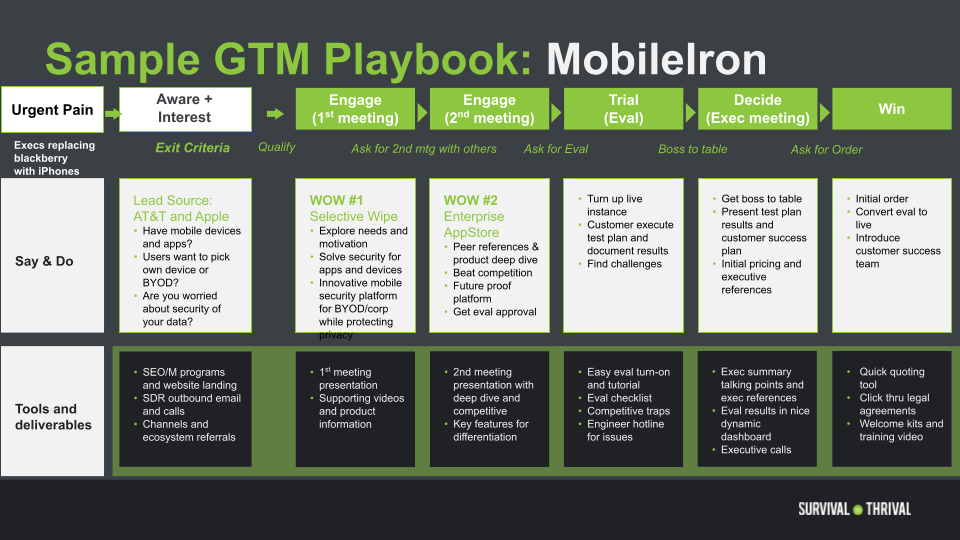

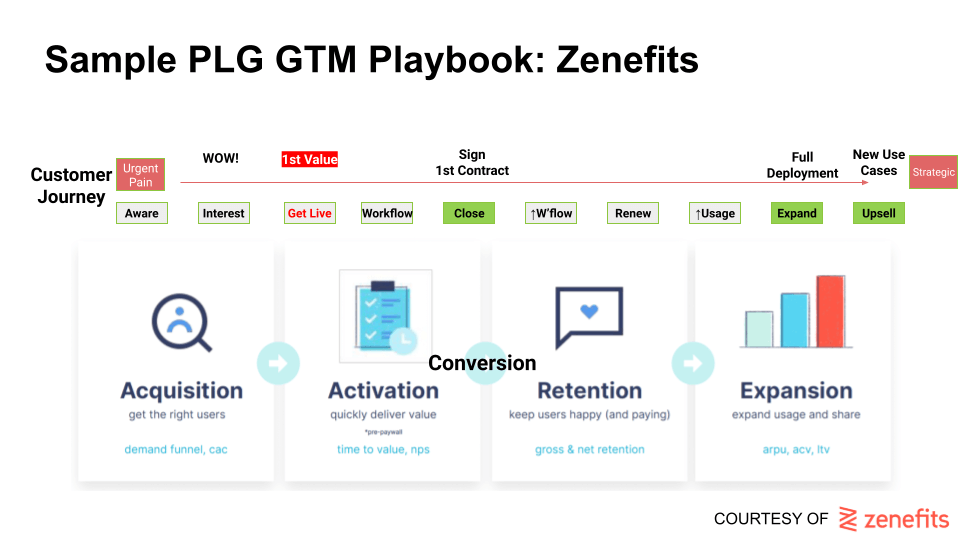

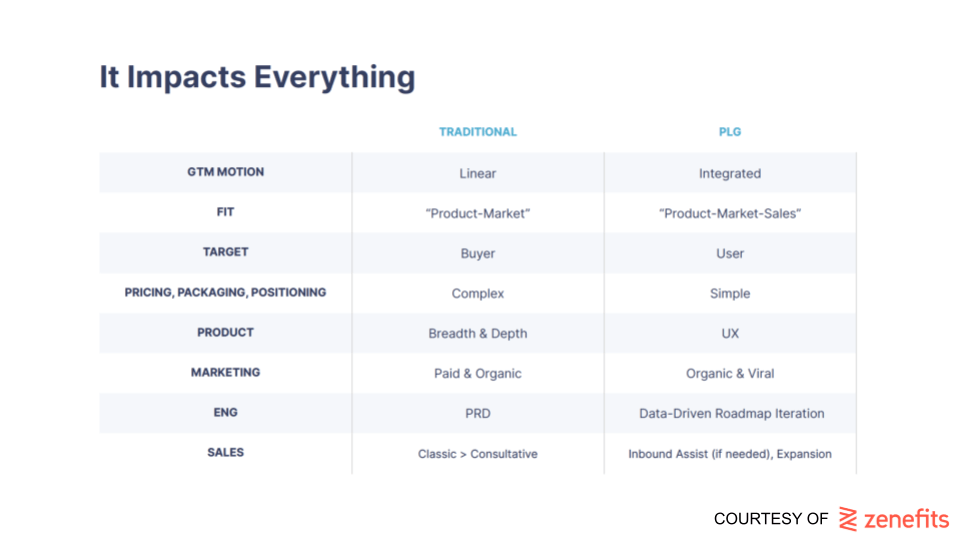

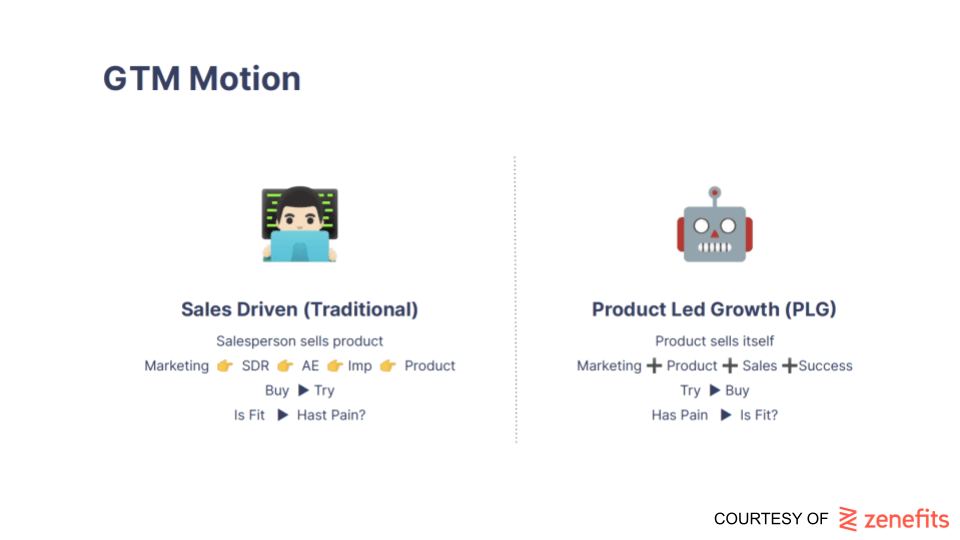

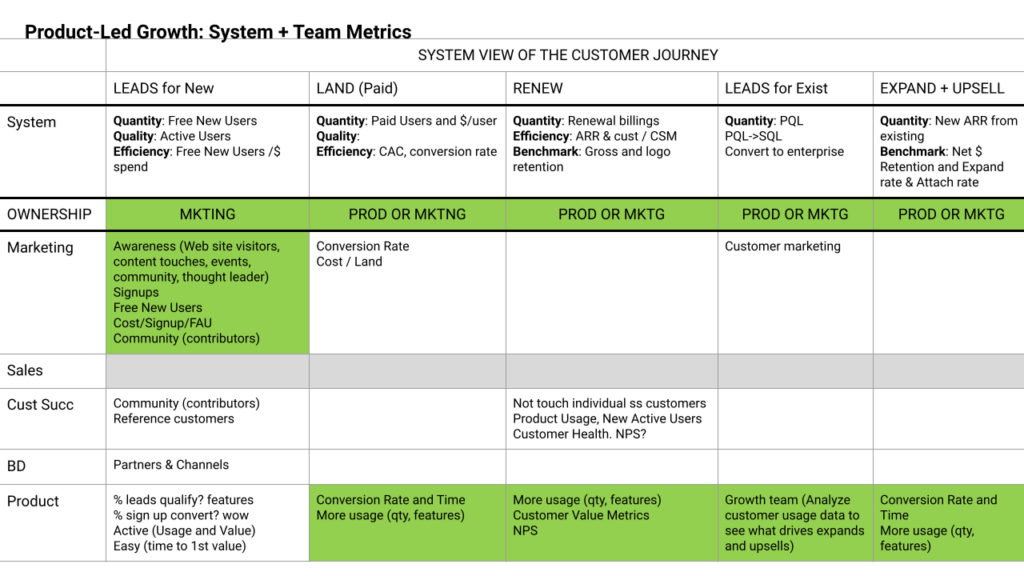

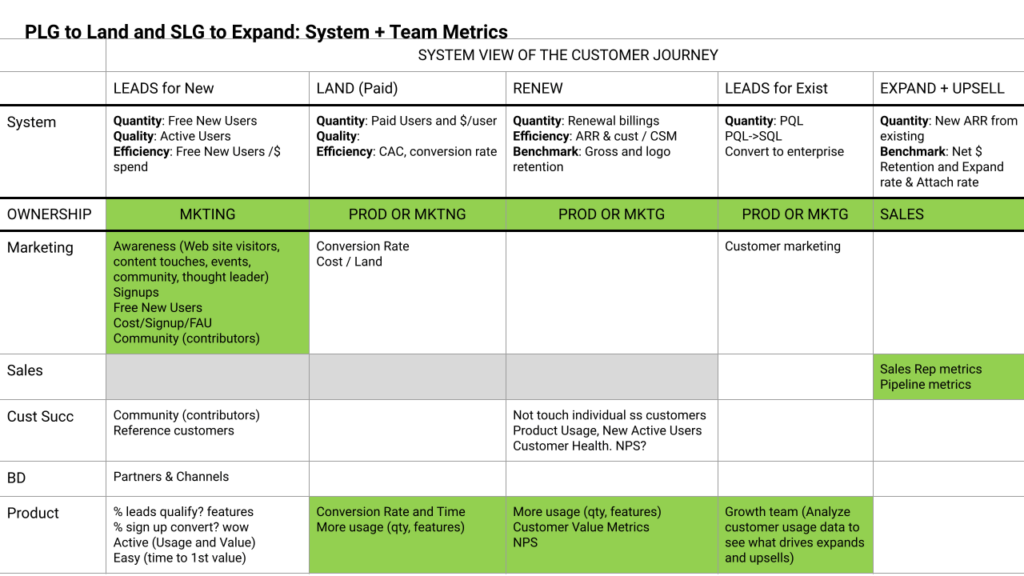

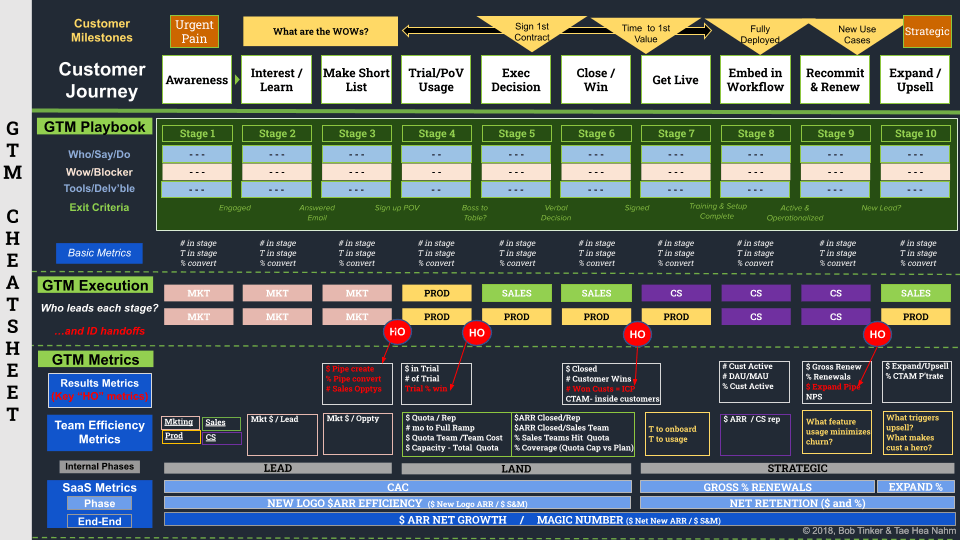

Step 2 is to Build The Right Surfboard: Your Repeatable GTM Playbook. The GTM playbook is a step-by-step, repeatable recipe to find and win deals over and over again. It becomes the blueprint for your marketing and sales teams. It becomes the bible for every new sales or marketing person to ramp. It becomes a powerful tool to align the rest of the team behind a go-to-market plan. For this section, we interviewed Zenefits CEO Jay Fulcher to dig deeper into the differences between sales-led and product-led playbooks.

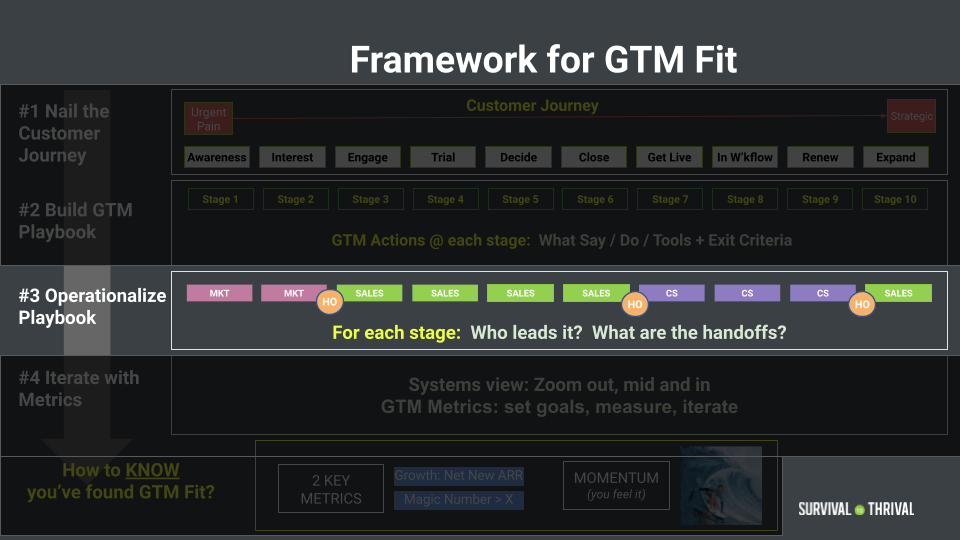

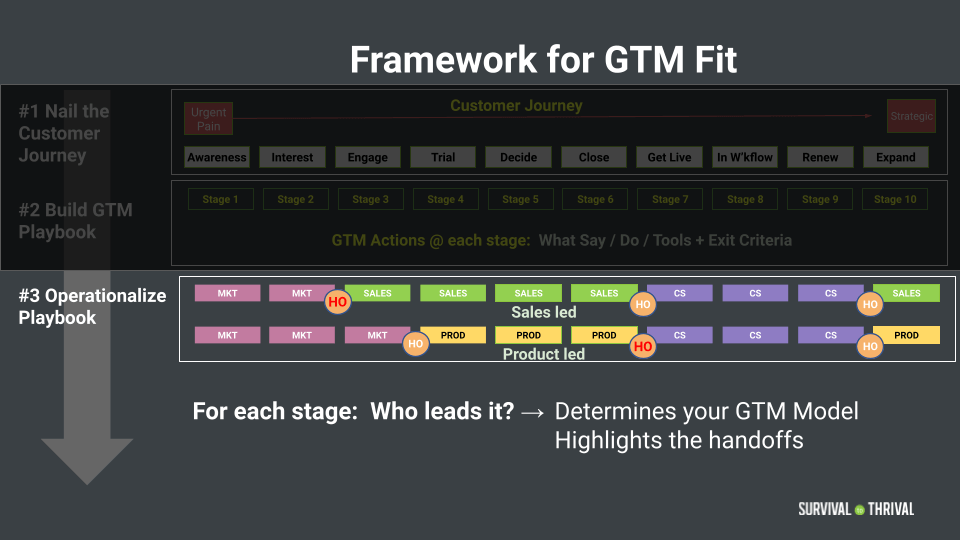

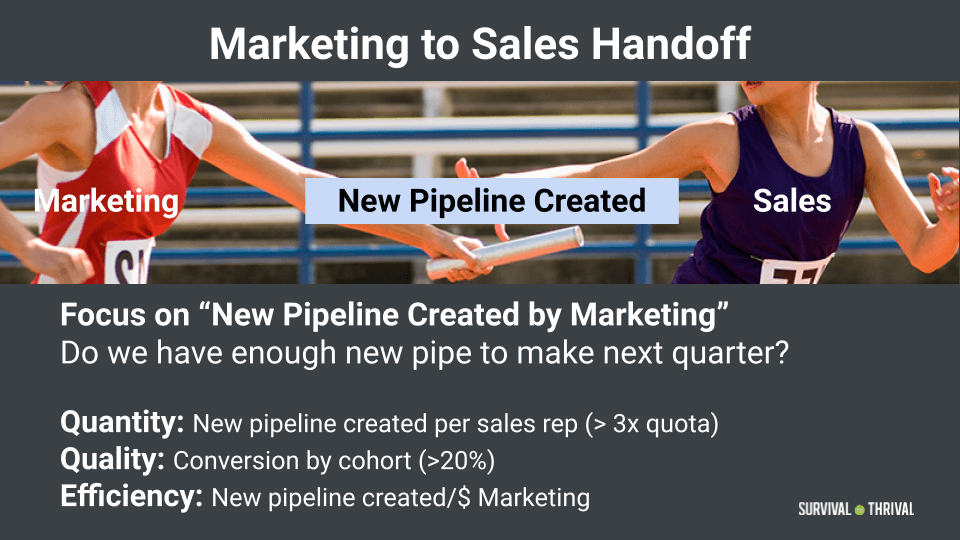

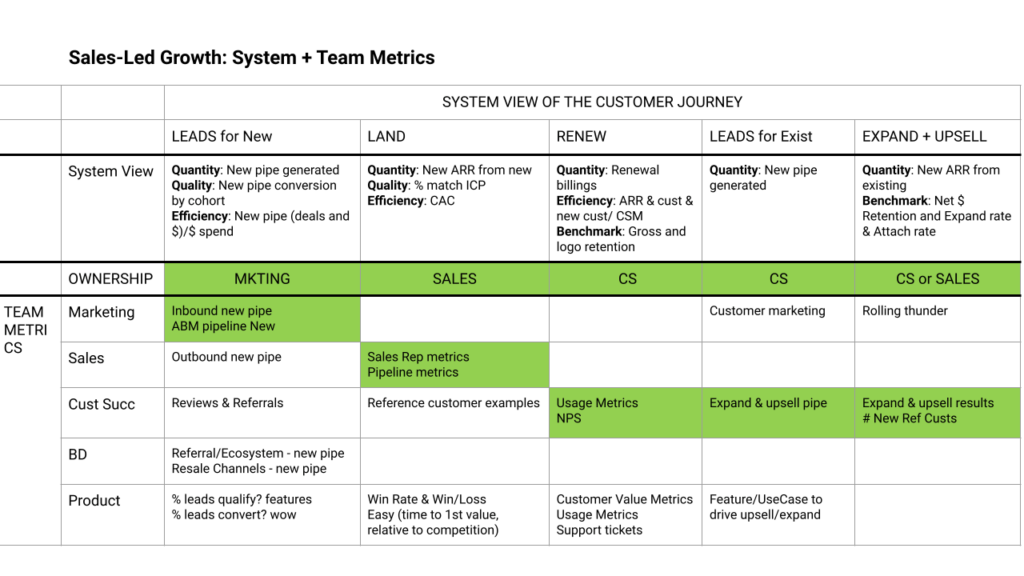

Step 3 is to Ride The Wave: Operationalize The Playbook. The GTM Playbook cuts across marketing, sales, customer success and product. It’s the most cross-functional project there is in a startup! Therefore the CEO is the only person with the visibility to see across the company — and the authority to get the whole company behind it. Moving through the stages of the GTM Playbook is like a relay race — passing the baton from one leader/team to the next. Identify which department or function takes the baton for each stage of the playbook. Like a relay race, the handoffs are where races are won or lost: the baton is either smoothly handed to the next stage, or it’s fumbled.

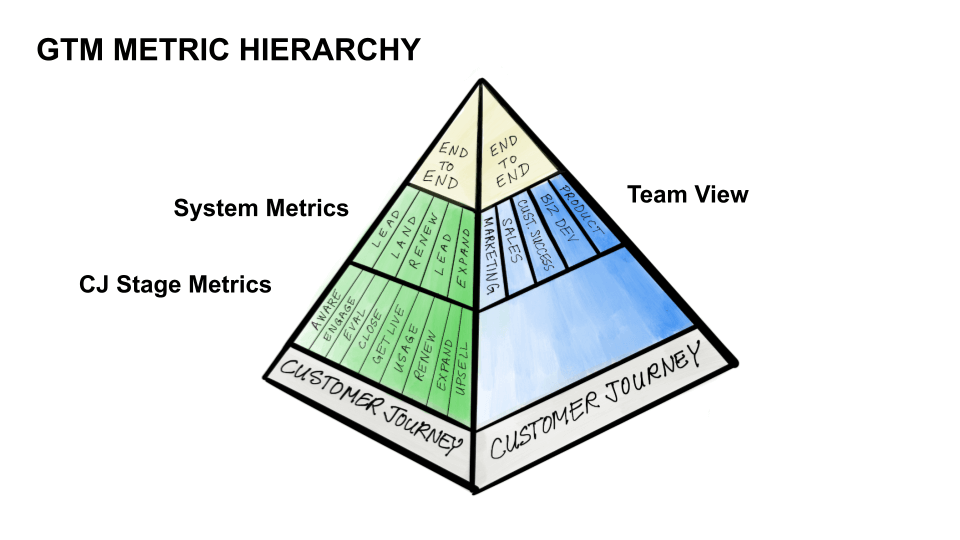

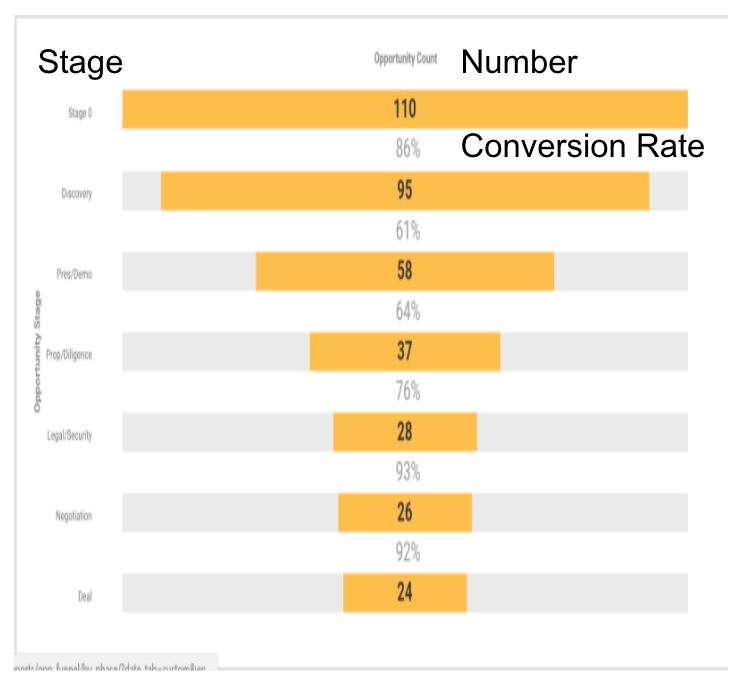

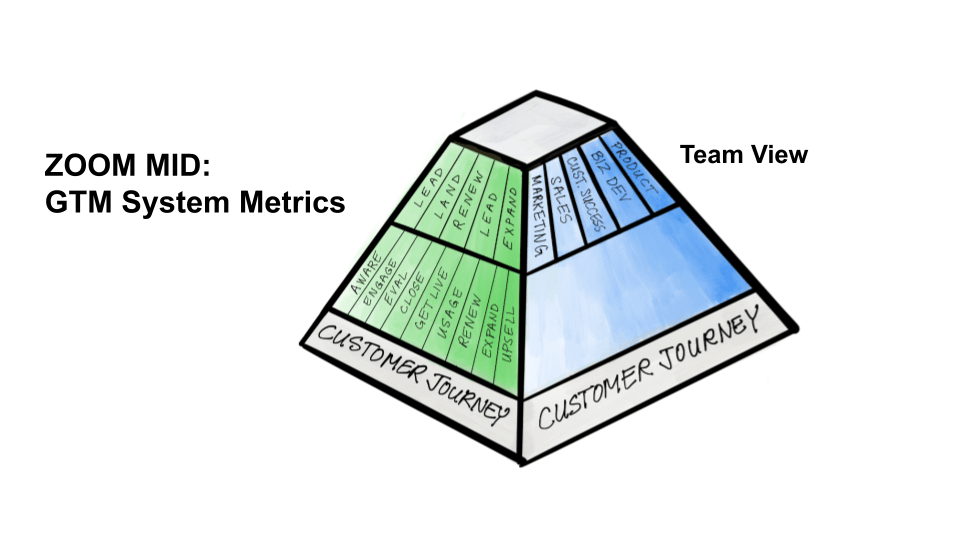

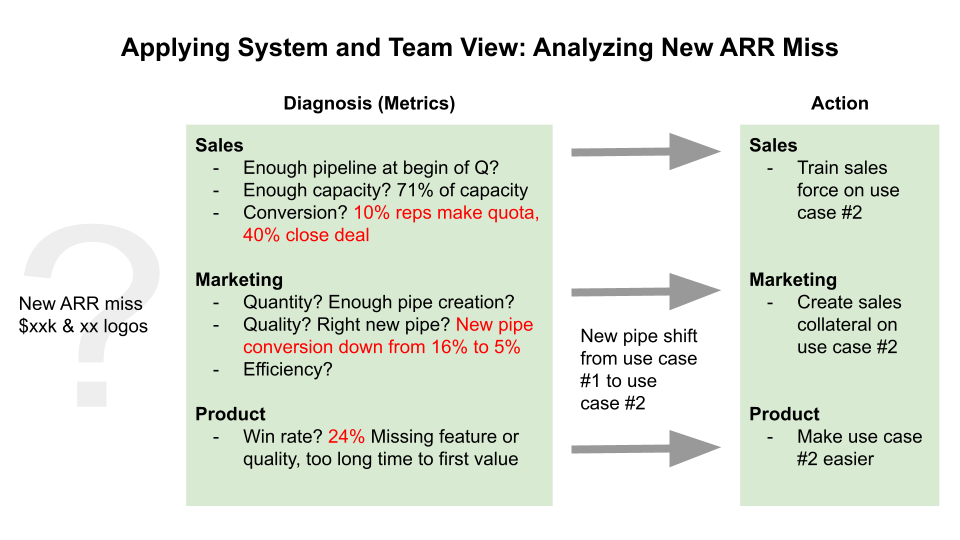

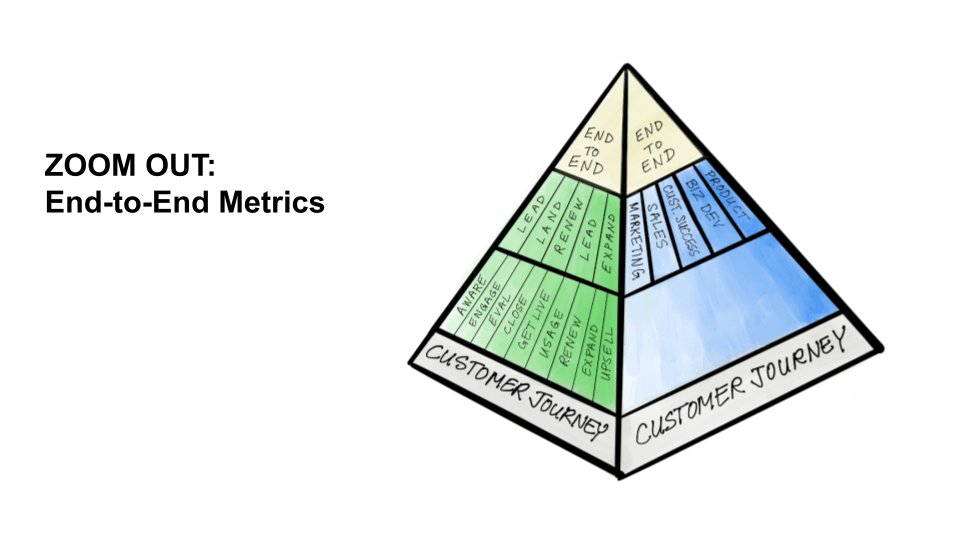

Step 4 is to Improve the Ride: Iterate On Your Playbook Using Metrics. We’ll explain how to understand the hierarchy of metrics and use it to diagnose and fix problems in your GTM. The key is to use the concepts of “variable zoom” and “system view.”

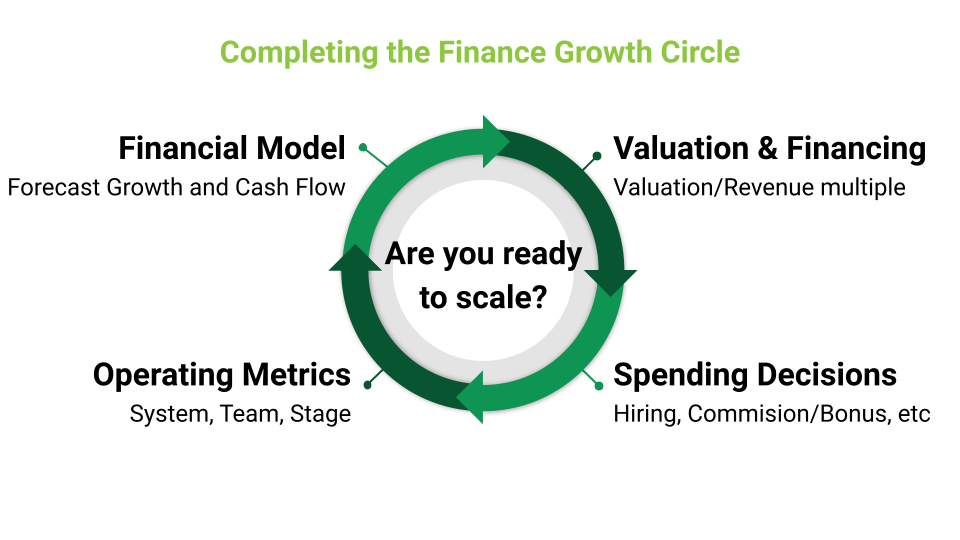

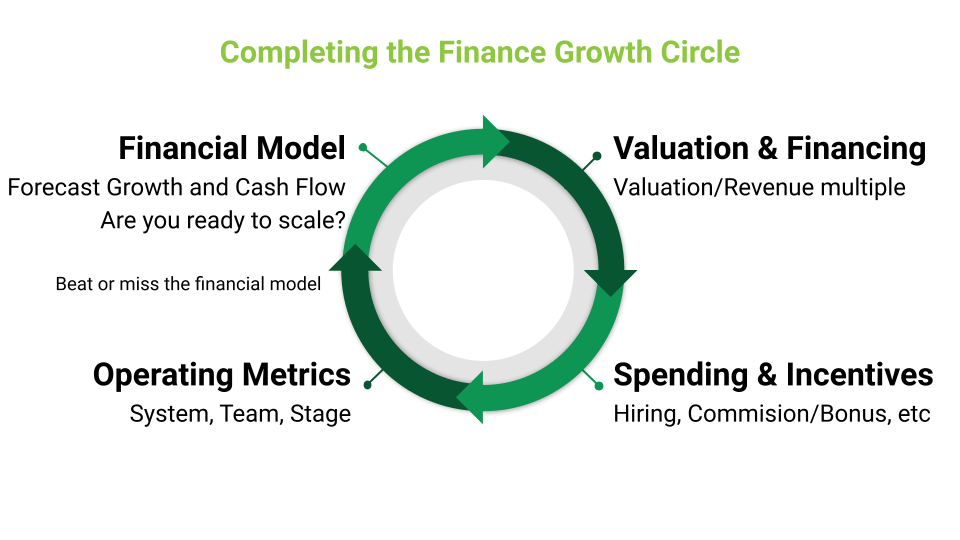

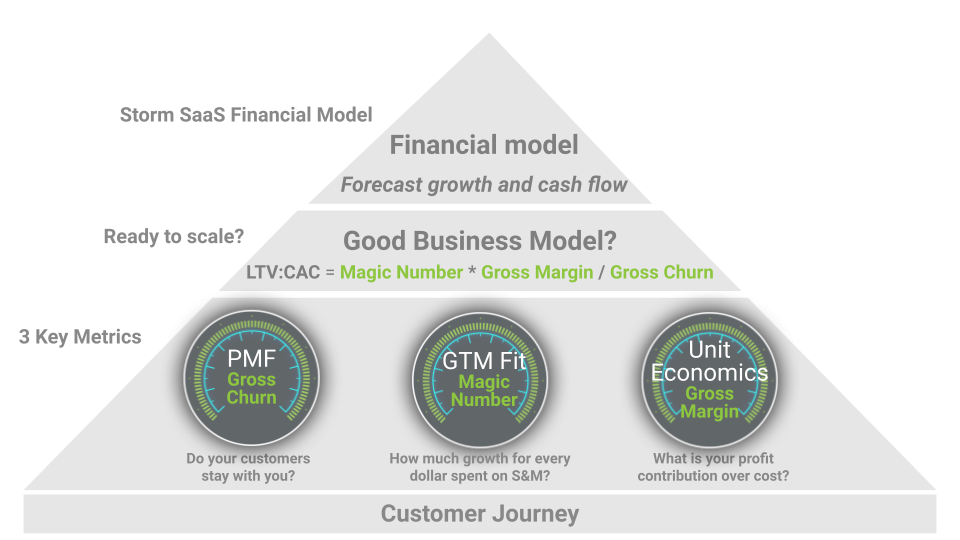

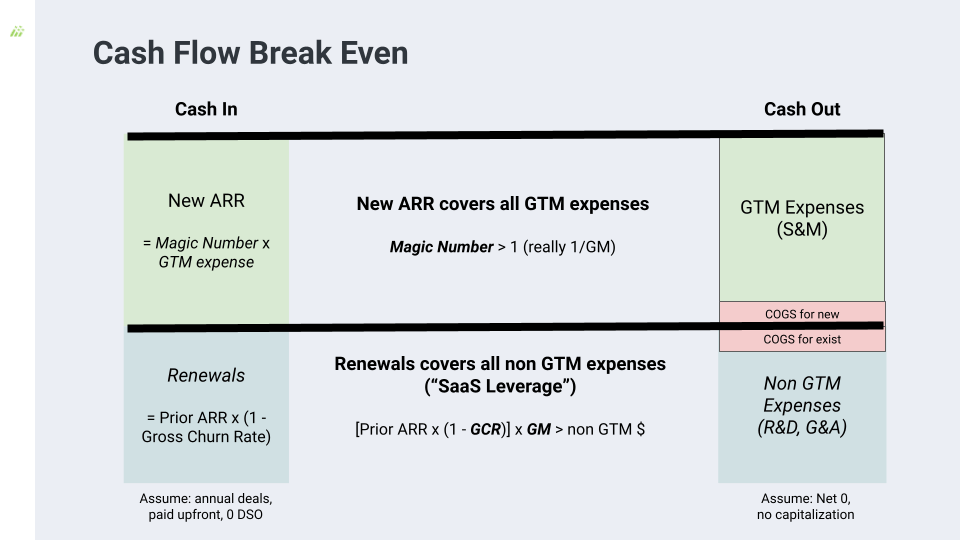

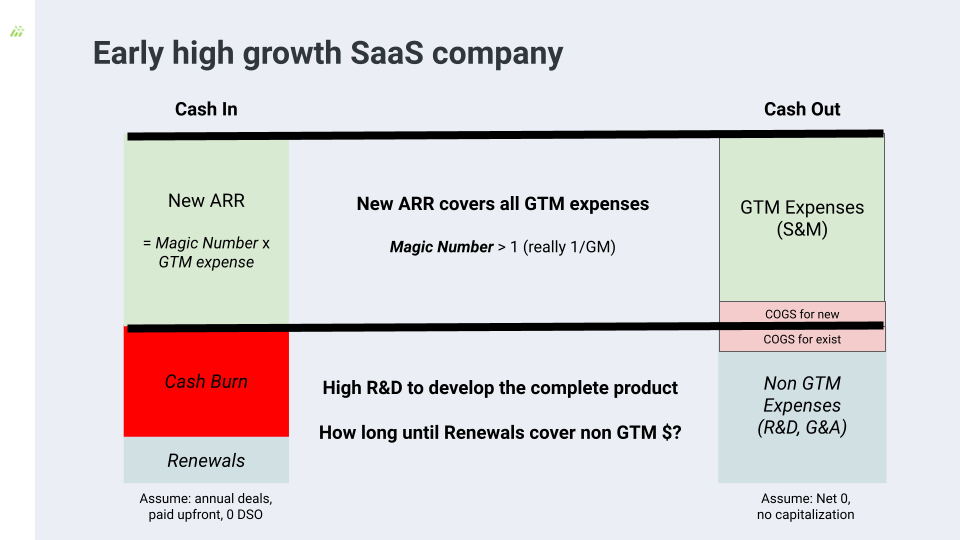

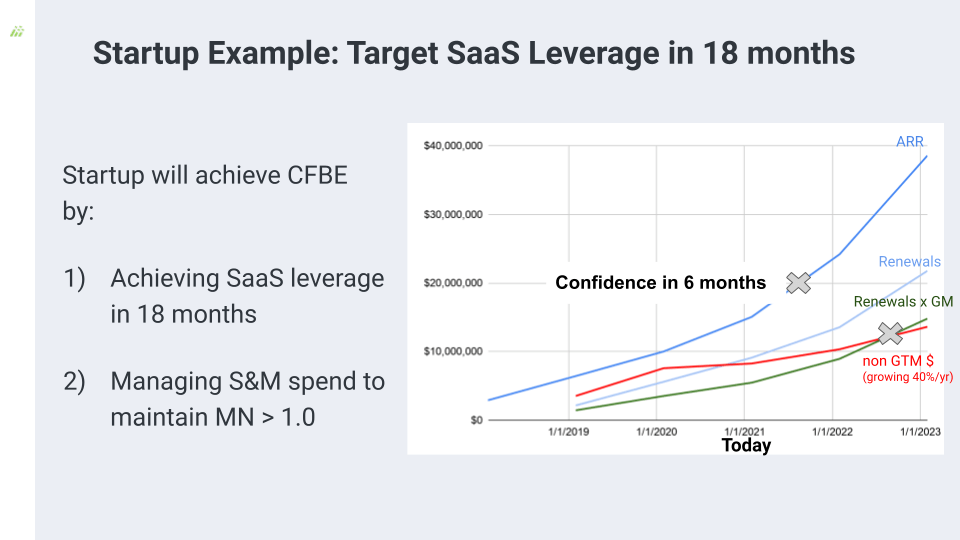

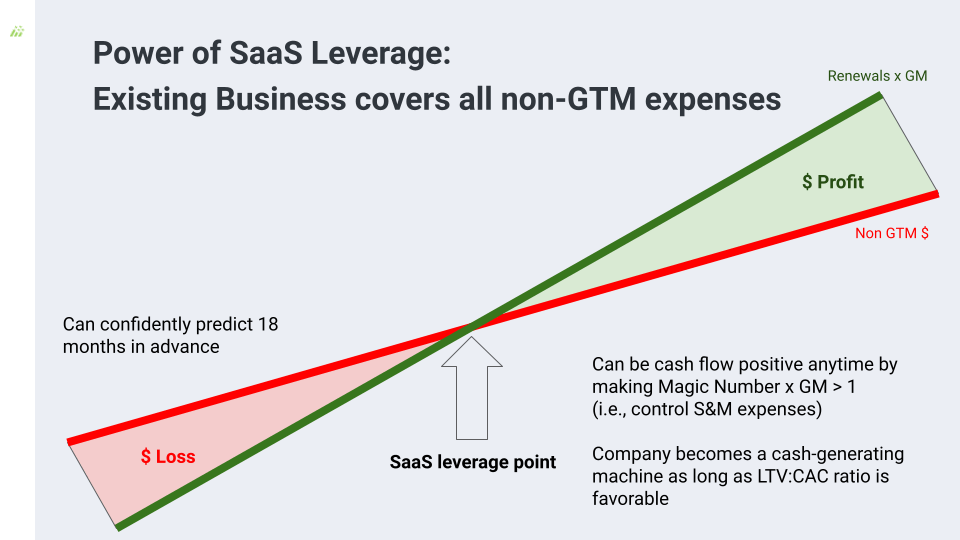

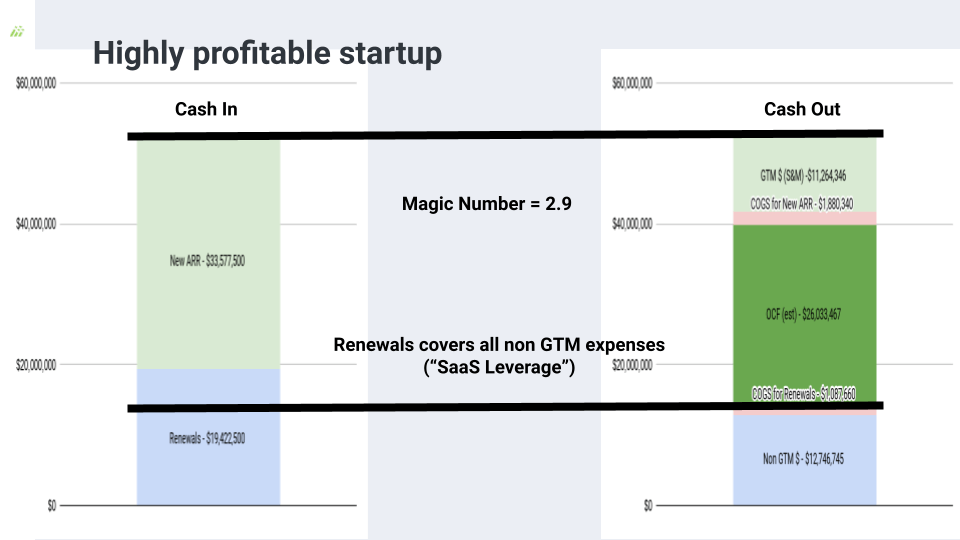

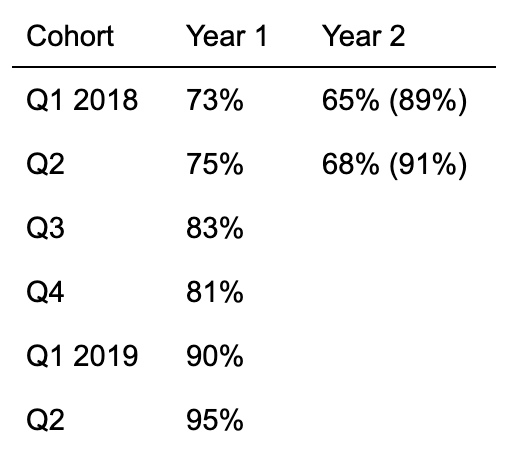

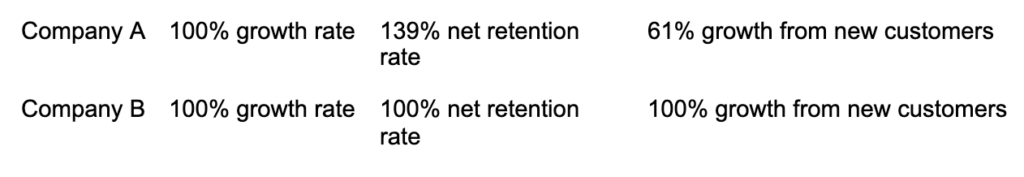

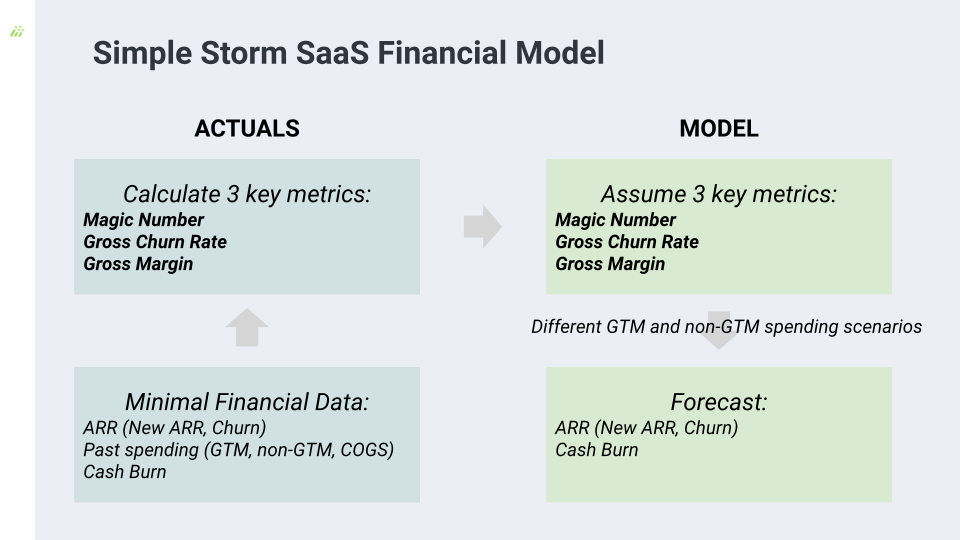

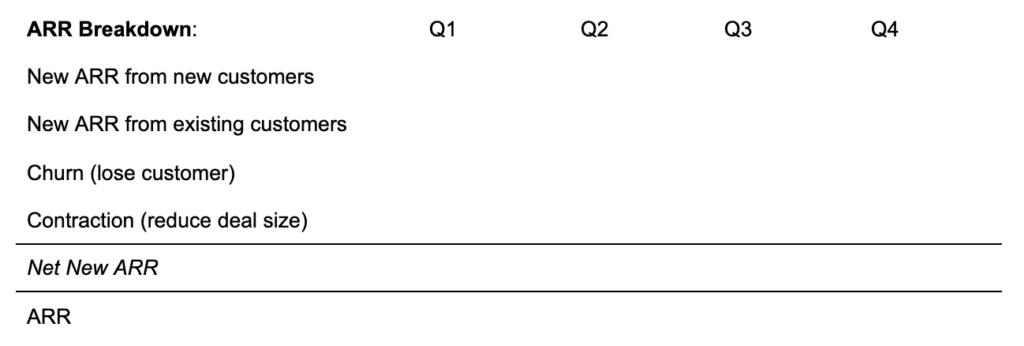

Finally, we’ll talk about your financial plan for Post-GTM Fit. After finding GTM Fit, CEOs want to rapidly scale. But investors want to know if they’ll make money. In order to secure financing and execute the growth plan, the CEO needs to make a financial plan and complete the “financial growth circle,” as shown in the diagram below. We’ll show you how to do that with just 3 metrics.

How to Send Feedback

We’d love to hear from you! UNLOCK is a living document and a work in progress, and we hope it will improve as we incorporate feedback from our readers. Please feel free to drop us a line in the feedback box or at [email protected].

About Survival to Thrival

The Survival to Thrival series is a mindmeld of a three-time entrepreneur, a long-time venture capitalist, and an entrepreneur community who share their learnings and unlearnings. Our mission is to help you succeed, anticipate what is next, and most importantly, understand that you are not alone.

We — the authors — are Bob Tinker, a three-time enterprise entrepreneur, and Tae Hea Nahm (pronounced Tay-Hee Naam), a long-time venture capitalist. We spent the last 20 years on the battlefield together as an entrepreneur-investor combo team, and fortunate enough to help build two enterprise startups from zero to high growth, resulting in one acquisition and one IPO. The first, WiFi company Airespace that was bought by Cisco for $450M, and then mobile security company MobileIron that we took public in 2014.

Survival to Thrival began as a book series. Our first book, The Company Journey, is all about how to find GTM Fit and unlock growth. Our second book, Change or Be Changed, is about how to adapt and persevere when growth is hard on the team. In each episode of our podcast, we discuss key topics underpinning the book series. Our GTM Fit Guide UNLOCK is our latest collaborative project.

GTM Fit Basics

When many enterprise startups get to PMF, they feel they’re ready to take off. “We have product-market fit! Let’s grow! Hire sales! Invest in marketing! Spend!”

The unfortunate frequent reality kicks in. Instead of sales taking off, sales just bump along. The number of new customers grows sporadically, painfully disproportionate to the rapid increase in sales and marketing.

“We hired sales and invested in marketing, and the only thing that went up was our cash-burn! We’re frustrated. Our investors are antsy. What gives?”

What gives is this: PMF is sufficient to create growth and acceleration in consumer startups, but it’s not sufficient to create growth and acceleration in enterprise startups. The enterprise journey is different.

Many enterprise startups get to PMF but don’t achieve growth and acceleration.

Why? Because there’s a “missing link” between PMF and accelerated growth for the enterprise startup journey.

The missing link is something we call Go-To-Market fit, or GTM Fit. We think it’s every bit as important for enterprise startups as PMF.

Developing and achieving GTM Fit is the number one thing about building a business that enterprise startups miss. Too often, founders and early investors assume that rapid growth will immediately follow PMF. This is natural. They believe strongly in the product and the market opportunity.

PMF does not factor in how a startup found and won its customers, how repeatable its wins are, and what those wins cost. But rapid growth for an enterprise startup only comes when the company can line up PMF with a go-to-market motion that repeats and scales to find and win customers over and over again. GTM Fit does all of that. It provides early proof of your GTM motion and reveals early signs of momentum and growth.

What is GTM Fit?

So, what exactly is GTM Fit?

“This may sound simplistic, but you have GTM Fit when you have a ‘Yes’ answer to these two questions: ‘Do you feel customers pull you in? And, do you have a one-page playbook for repeatable wins?‘”

–Bob

What’s a metaphor for GTM Fit? GTM Fit is the difference between paddling and surfing. Paddling is painful. Surfers expend a tremendous amount of energy paddling for relatively little progress. Without GTM Fit, companies struggle to win deal by deal, spending lots of cash and energy. Tensions run high as growth is hard, repeatability is missing, and everyone stares at the rapidly impending zero cash date.

Once you find GTM Fit, you’re no longer paddling for your life. You’re surfing a wave with lots of leads where deals convert and repeatability is visible. For every dollar you put into sales and marketing, you get more than a dollar out. In other words, it’s pure momentum.

When to Look for GTM Fit

Start looking for GTM Fit midway through the search for PMF. Why? The customer interactions at the latter part of PMF provide major clues for and help inform the iterations to find GTM Fit.

In particular, pay close attention to customer behaviors during the latter half of PM Fit: what got their attention; why do they spend time with you; who commits and who doesn’t; who moves fast and slow; why did they buy and why did they not; and who actually makes the purchase decisions. The mixture of positive and negative data points are hugely valuable market signals for finding GTM Fit.

Why Does GTM Fit Matter?

Okay okay, surfing instead of paddling sounds all well and good — but do you really need GTM Fit to do that? Isn’t it enough to achieve PMF and scale up? Yes — if you want to waste a lot of time and money!

Some who believe PMF is sufficient to unlock growth will recommend that the simple answer is “hire more sales” or “invest more in marketing”—essentially spend your way to GTM Fit. That rarely works. Without urgency and a repeatable recipe to find and win deals, increasing sales and marketing spend is like throwing money against the wall.

The pressure to hit the gas on sales and marketing will be enormous, but don’t do it until you can see the repeatable GTM playbook and GTM Fit. Setting an explicit GTM Fit milestone with the board and the leadership team will help everybody manage expectations and create focus. Once you have GTM Fit and feel the momentum, then it’s time to hit the gas.

Finding GTM Fit is hard. The stakes are high. The search is stressful. It creates cultural and organizational changes, as GTM becomes as important as product. At the same time, it allows you to win customers, and that’s energizing. Seeing patterns emerge that can be repeated makes everybody in the company realize that they’re not crazy. Hiring grade-A talent becomes much easier. You pick up momentum, and it’s a blast.

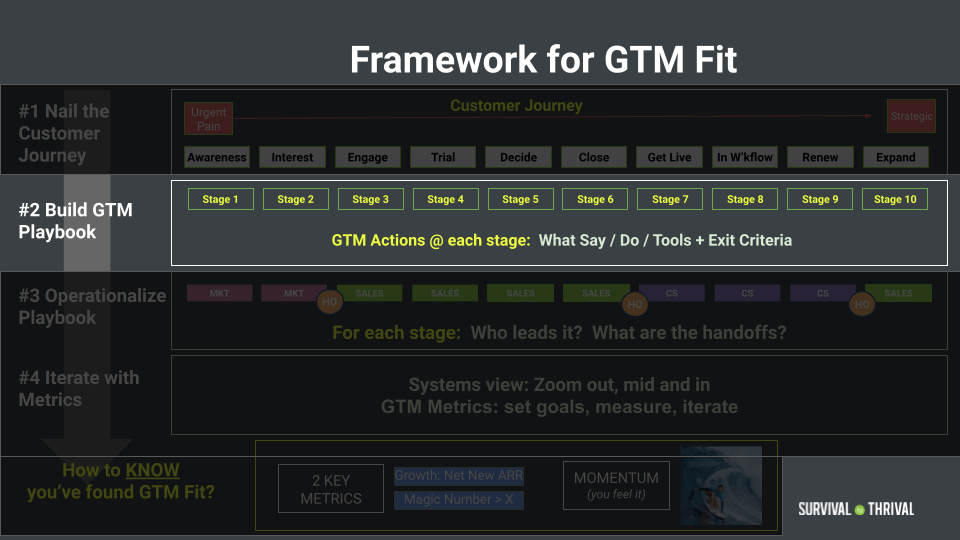

The 4 Steps to GTM Fit

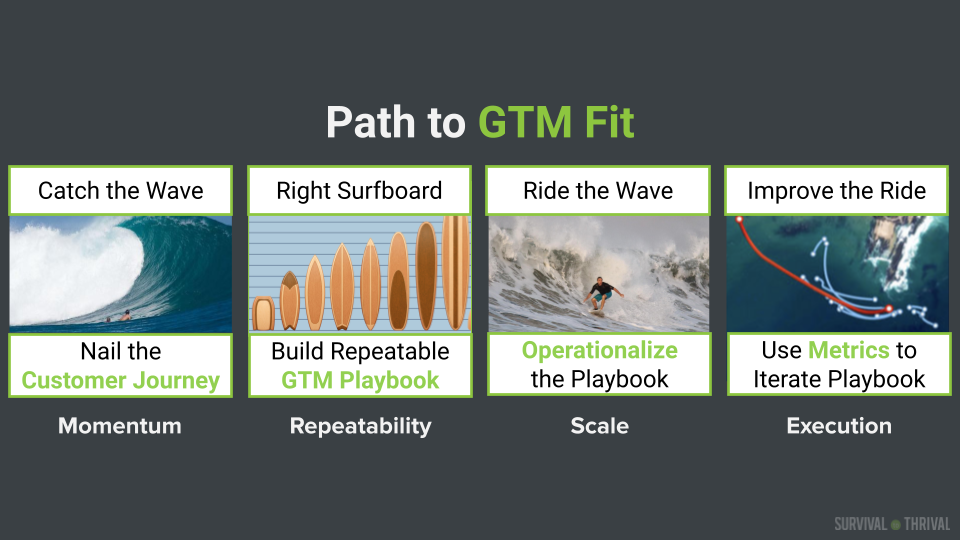

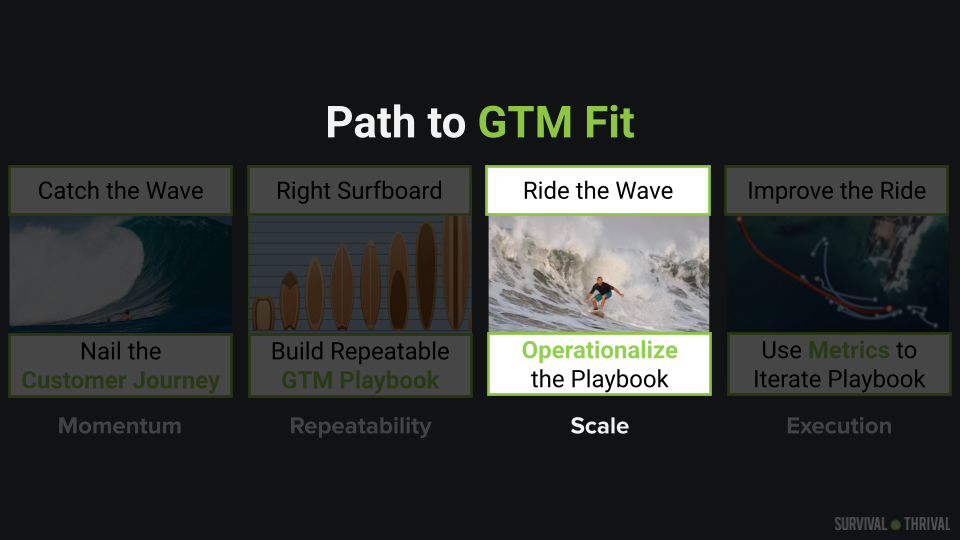

Let’s break things down. (And keep using the surfing metaphor because, well, we like it.) Finding GTM Fit is a challenge that has four parts:

- Catch the Wave: Nail the Customer Journey — and you harness lots of momentum.

- Build the Right Surfboard: Create a Repeatable GTM Playbook — and you get repeatability.

- Ride the Wave: Operationalize the Playbook — and you can scale the GTM.

- Improve the Ride: Iterate with Metrics — and you can improve GTM execution.

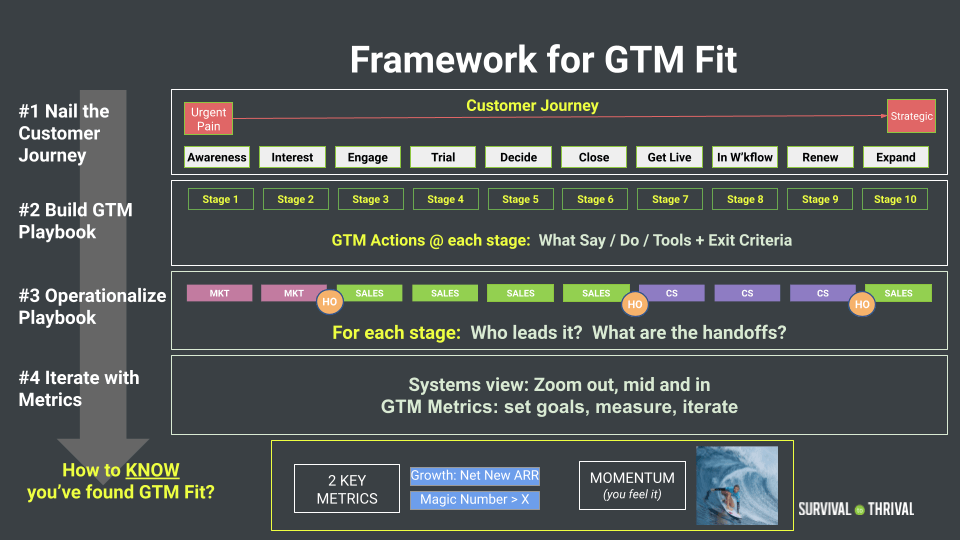

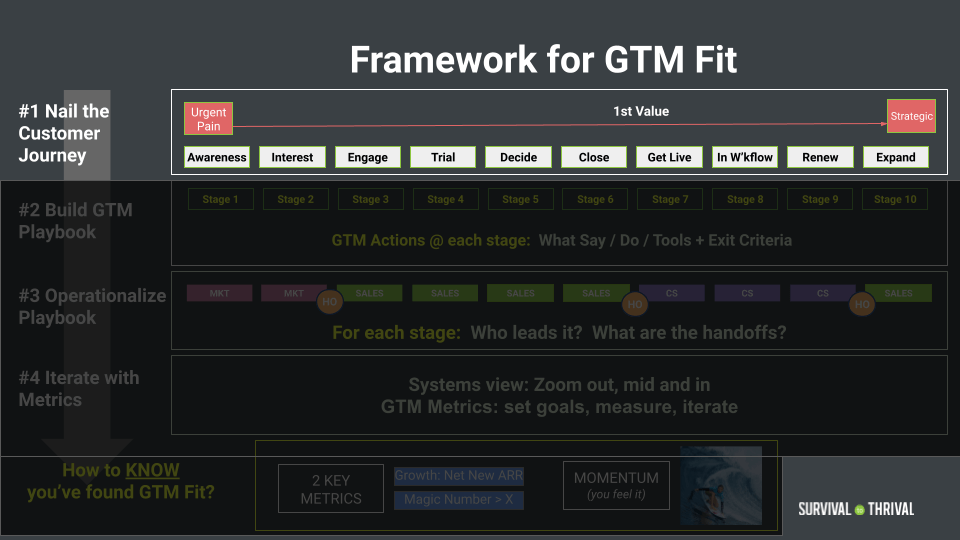

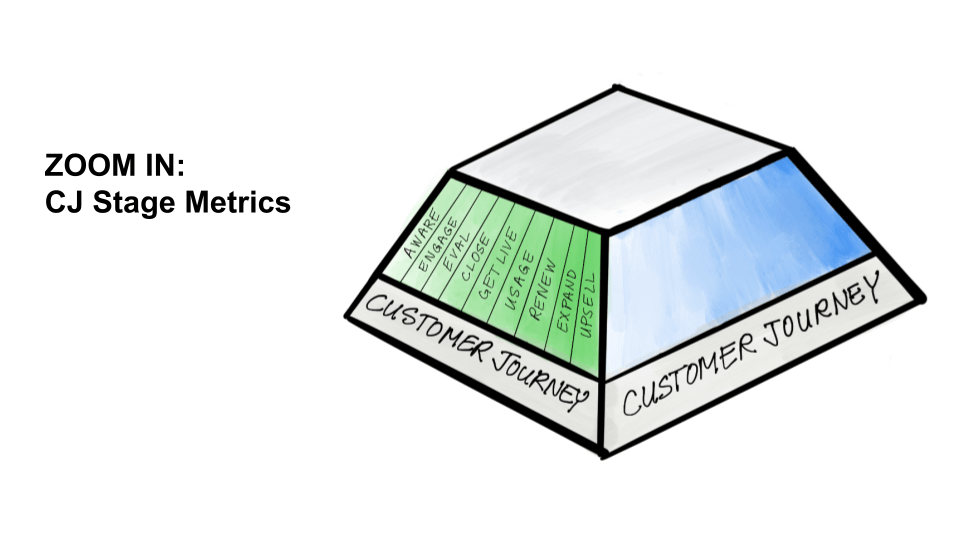

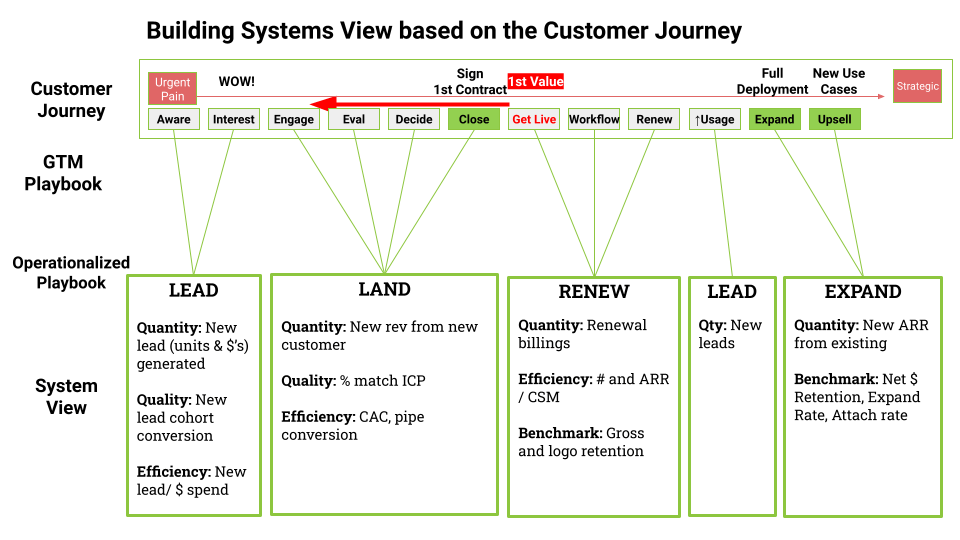

The four-step path to GTM fit starts with the Customer Journey (CJ), the framework for your GTM Playbook (see graphic below).

As you follow the path to GTM Fit, each step builds on the last, mapping onto what you’ve done before. When you reach the end, you’ll be able to see how everything fits together. If it sounds intimidating now, don’t worry. We’re going to take things step by step.

#1 Catch the Wave: Nail the Customer Journey

You can’t surf if you don’t catch the wave. But it’s not enough for surfers to find a wave — they need to read it, too. Is it a beach break, a reform wave, or a double-up? The structure of the wave will determine the surfer’s approach.

For the enterprise startup, finding the wave means identifying the Urgent Pain for the Ideal Customer Profile that drives customers to buy now. The wave starts with the Urgent Pain for the Ideal Customer Profile and ends when your company becomes strategic to the customer. This is especially critical for SaaS startups, since signing the contract is only the beginning of the relationship with the customer, and so much of the business is based on renewals and upsells.

The Customer Journey (CJ) is the backbone of your entire Go-To-Market. Everything else is built on top of it. Nailing the CJ means:

- Start with the Urgent Pain

- Work out the Full CJ — Including the 7 Key Milestones

- Win first customers

- End by becoming strategic to the customer

Let’s start with the first part.

Start CJ With the Urgent Pain

The first step of the CJ is the Urgent Pain.

Without an Urgent Pain, there is no GTM Fit. Period. Growth will be slow and painful. Why? Urgent pain drives leads. Urgent pain drives customers to engage. Urgent pain drives customers to decide to buy. Urgent pain drives customers to buy new products from new companies vs legacy vendors. But most importantly, the urgent pain answers the question:

“Why buy now, versus a year from now?”

If you can’t answer that question, you do not have urgency. It’s that simple. Without a clear urgent pain, why should the customer put their reputation on the line to buy a new product from a new company? Or maybe they do engage with you, but it’s endless educational meetings and a never-ending sales cycle. Why should they even bother to spend their valuable time engaging with you at all?

Usually, the urgent “why now” problem won’t feel like a sexy way to disrupt the status quo. But finding this pain is important, because it creates the entry for the enterprise startup, and motivation for immediate customer action. And by addressing an urgent pain for your Ideal Customer Profile (ICP), you can methodically find and catch the wave of momentum.

So, how do you find the urgent pain that drives GTM Fit? By being open-minded and searching systematically. Some find the urgent pain by luck or magical founder intuition, but some companies find the urgent pain through a systematic search process:

- Be open-minded and cast a wider net — even it feels like heresy

- Document all the data — even it feels irrelevant at the time

- Find the patterns and hotspots

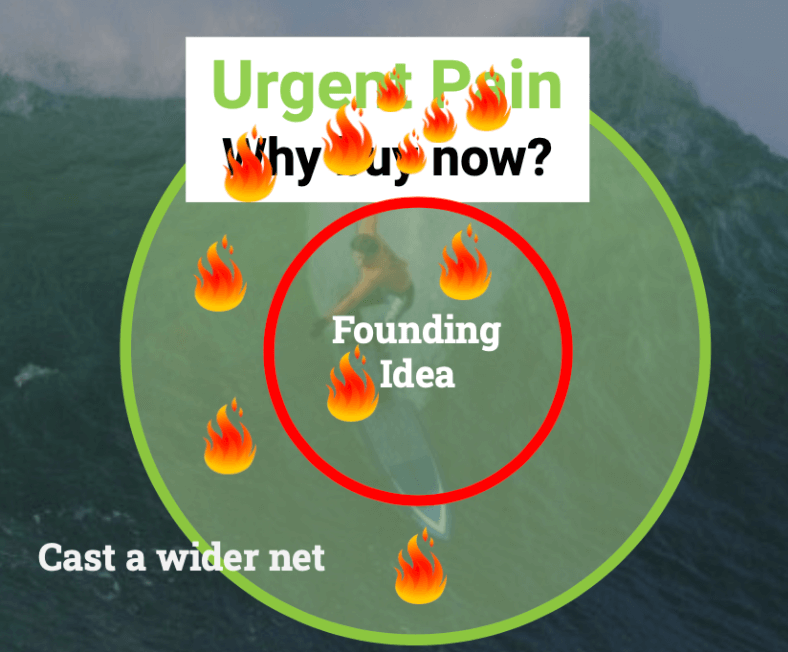

Be Open-Minded and Cast a Wider Net — Even if it Feels like Heresy

Imagine the enterprise startup surfer in the water. The startup paddled very hard to the spot where they think the urgent pain should be. But the urgent pain might not be there. It might be a little to the right. Or a little farther in front. Or a few yards behind. Regardless, the urgent pain is probably not where they thought it was when they started the company. It needs to be searched for — systematically. And that’s hard. Because finding the urgent pain almost always requires the startup to commit “founder heresy.”

Every founder has a founding idea — the reason why they upended their life, quit their cushy job, and terrified their friends and family in the name of building something revolutionary. To the founder, this idea is the guiding light, the raison d’être that justifies all the blood, sweat, and tears.

Conventional wisdom tells startups to “focus, focus, focus” and drill down on the founding idea. But the truth is that overly dogmatic focus on the founding idea can be fatal. And as attractive as the founding idea may be to the founder, the urgent pain for the customer is often adjacent. It’s not exactly the founding idea. And it’s not the founder that’s buying your product. It’s the customer.

But to find the urgent pain, you must go against the conventional wisdom and overcome resistance. Changing the founding idea feels like heresy, but it may be the right thing to do. And the only way to find out is through experimenting, casting a slightly wider net — and listening to the data.

Test Adjacencies

Start with the initial focus on the product-market hypothesis, but also cast a slightly wider net for adjacent pain points and customer segments.

Targeting product-market adjacencies doesn’t come free. Testing them diverts resources from the original idea. There is no hard-and-fast rule on this, but spending 20–30 percent of your energy testing adjacencies provides enough coverage to detect a potential hotspot that may be outside the initial focus.

Ask customers “what other problems are you struggling with?” Deliberately meet customers in different segments. Ask probing questions “if we had such-and-such, what would that mean to you?”. Modify initial pitch decks to catalyze exploratory discussions. Be willing to test adjacencies with digital marketing, prototypes or mockups.

“One mistake I see startups make over and over again is to be too enthusiastic and pushy at the start. You need to read the room and sense where the customer is at. What do they need? What problems do they need solved? When I’m ready to buy, I’ll buy. And when I say I’m ready to meet tomorrow, be ready to meet tomorrow. Not next week.”

Ashwin Ballal, EVP & CIO, Medallia

Testing adjacencies complicates early sales calls, because they won’t be identical and will require some nimbleness. Emotionally, too, admitting the need to spend energy on adjacencies can be difficult for founders and first developers, since by definition they are passionate believers in the founding idea. Pursuing anything else can seem like heresy!

Document All Data — Even if it Feels Irrelevant

Finding the urgent pain starts with getting the data: talking to customers and documenting those conversations.

Talk to Customers

Who decides what the urgent pain is? Your customers do. And there’s only one way to find out about their pain points: talk to them. Ask enough questions and listen closely enough, and your customers are bound to reveal what’s really bothering them — and what they’d pay to solve ASAP.

Be Unbiased

Here’s a typical situation. The startup has two kinds of communicators: the Evangelist and the Listener. (They could be salespeople, though these personality types are not limited to sales. For example, the founder is often an Evangelist.) The Evangelist is articulate and deeply passionate about the founding idea; they’re a great spokesperson for the product. However, because the Evangelist has a strong idea of what the world should be, they’re not in tune to the customer’s perspective. When the Evangelist does listen, they selectively hear only things that reinforce their point of view. The Listener, on the other hand, is the complete opposite. The Listener may not be particularly well-spoken, but they’re great at paying attention to the customer, taking notes, and figuring out what’s relevant.

Though you need an Evangelist to win customers, you need a Listener, too, especially when you’re looking for the urgent pain. In the early days of the startup, the team has to have an open mind. If you’re too focused on the founding idea, you may miss the adjacencies. That’s why it’s important to document.

Document, Document, Document

If data isn’t recorded, it might as well not exist. Later on, it’s too easy to forget, or worse, selectively recalled to fit a certain narrative. The loudest voice in the room often gets the most attention — even if it’s wrong. Beware of internal biases and only listening to what you want to hear.

To avoid these pitfalls, verbatim documentation is critical. Starting from the very first sales call, the sales and marketing teams should make notes of everything that happens. What are your reps saying? How are customers responding?

Organizing data is key to analyzing it later. It’s helpful to have a template of questions for capturing feedback, like a spreadsheet or questionnaire.

Find the Patterns and Hotspots

With data in hand, the next step is to find the patterns. Fair warning: this next part will be exhausting.

Lock the Team in the Room

To identify the patterns in your data, lock your team in a room and grind through 20-40 customer deals that you both won and lost — one by one, on a whiteboard. Find out what happened in each one — and why.

Why does the whole team have to do this? Because all the information about your customer interactions is distributed across people’s brains, and each one of those brains adds its own biases. That’s why it was so important to document customer data. Because only data can cut through opinions, biases, and anecdotal evidence. The whole team needs to be together — to contribute their perspectives and get on the same page. They even have to agree on what questions to each potential customer and their specific wording.

This process will be painful. It will take hours. It will be worth it.

Challenge Box

Team Members Aren’t on the Same Page.

If you ask every member of your team what’s driving deals and what’s getting in the way, chances are you’ll get a slightly different answer from everyone. And that’s not all. Opinions, hierarchy, biases, and anecdotes all tend to get in the way of making objective evaluations. To find the urgent pain that drives deals, you must arm yourself with the data to cut through the noise.

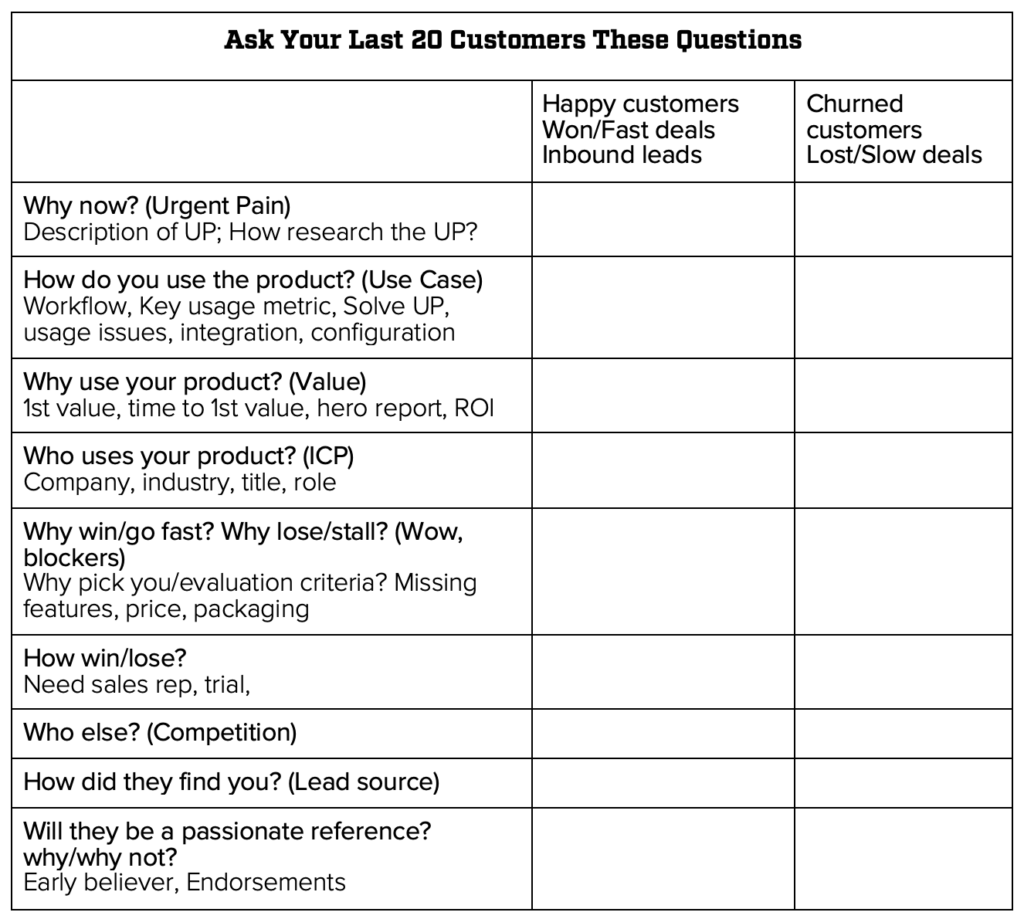

Take 20 Won 20 Lost Deals: Answer the Key Questions

To work through the deals, start with the customers you have won, and ask these questions:

Patterns Will Emerge

As you grind through the deals, patterns will (hopefully) emerge. What drove interest? What drove deals to move? Which types of customers? What use case? Why did some slow down? Why did you lose? Are there patterns coalescing around the deals that succeeded? If so, these are clues. Deals that were lost can be equally instructive. Every win, loss, stuck deal, or uninterested customer is the world teaching you.

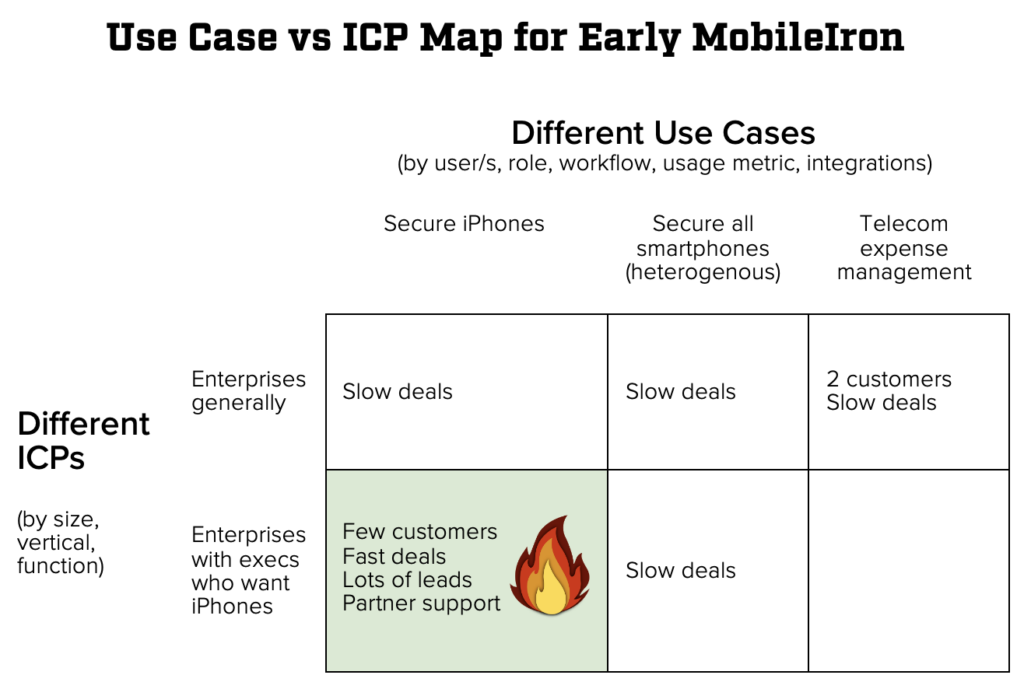

The key here is to move from anecdotes to analysis and visualization of patterns. It can be a very powerful exercise to bring together and look for patterns in the who, why, and why nots, and then make them visual. Often, a use-case/customer grid emerges with various hotspots and cold spots — around different potential ICP’s or different use cases.

What you’re looking for is a repeated pattern of success with a certain kind of customer for a specific pain point. And when the data coalesces around a certain combination: bingo. You’ve found your hotspot — a combo of urgent pain and your Ideal Customer Profile (ICP).

Challenge Box

What happens if you have more than one hotspot? Painful sacrifice.

Often a startup achieves PMF, with customers clustered around the several hotspots. As a result, the GTM team now has a pipeline of potential customers clustered around those hotspots of pain points and buyers. Understandably, any deal that brings in revenue in a reasonable time attracts attention from the GTM team and absorbs GTM bandwidth.

GTM Fit requires making the tough choice to line up the GTM playbook and GTM resources on one or two hotspots with the most urgency, and then sacrifice both current customers and future legitimate customer opportunities that are tied to lower urgency problems. It’s painful. Sacrificing customers and legitimate customer opportunities will drive a revenue-goaled GTM team crazy who worked hard to win those deals. But it’s a necessary sacrifice. Building a repeatable GTM Playbook cannot be focused on multiple hotpots. You must pick one. Making the hard call to focus the GTM playbook on one hotspot (ICP/pain combo) is often the hardest decision to nail GTM Fit and unlock growth!

Examples: Urgent Pains that Unlocked Growth

Here are just a few examples of how B2B startups have pivoted to the urgent pain and unlocked growth:

- MobileIron. MobileIron’s long-term vision of securely managed smartphones was attractive to prospects — but not enough to make them buy now. By listening to prospects, the team learned that execs wanted their IT departments to exchange their old Blackberries for iPhones — and they wanted it done yesterday. IT departments were hungry for a solution that helped them relieve the pressure from execs, and MobileIron could help them do just that.

- Sendoso. Early on, startup Sendoso built a platform that made it easy for customers to send a Starbucks gift card to prospects as a meeting-maker. But it turned out that an adjacent pain was much bigger and much more urgent. Marketing teams knew they needed to invest in the direct mail/gifting channel ASAP, but it was a nightmare to manually execute on sourcing, shipping, ROI tracking, and marketing/sales alignment. Sendoso could solve this pain by building a sending platform to automate the marketing closet of schwag for customers.

- Talkdesk. Talkdesk’s customers wanted to set up a call center, but the software was just out of reach for any company without robust IT. Talkdesk could solve this operational problem by allowing customers to set up a call center in only five minutes.

Common Mistake

Finding Urgency vs. Creating Urgency

It’s common to hear from the head of marketing that “we just need to create urgency” with the customers in order to sell the product. What’s wrong with that way of thinking? Instead of searching for your customers’ latent urgent pain, it means running around and scaring your customers into buying your product. It might generate a few sales, but it’s not a sustainable plan, because it relies on instilling fear rather than solving an existing problem. Taking the time to test adjacencies and discover the latent urgent pain is the only way to find a real path to GTM Fit.

Whether the startup stumbled upon the urgent pain by accident or extracted it through rigorous data mining to find the patterns, the takeaway is the same: without an urgent pain that answers the question Why buy now and not a year from now?, there is no GTM Fit.

Work Out the Full Customer Journey

Usually when execs think of the CJ, they think of “Lead, Land, Renew, Expand.” But that’s backwards! Startups need to look at the CJ through the lens of the customer — not the sales rep. The CJ is not the same as the SalesForce.com forecasting stages. The CJ stages come from observing what is actually happening inside potential customers as they engage with the startup. They capture the physics of the customer journey.

With the urgent pain identified, it’s time to work out the rest of the customer journey. So, lock your execs into a meeting room. Starting with the urgent pain, write down each stage of the journey on a whiteboard (see white rectangles in the diagram above for one example).

Nailing the GTM playbook is likely the first major cross-functional project that a team is forced to do, and getting everyone to agree on the stages of the customer journey will be a struggle. But it’s crucial that everyone get on the same page.

Here are some questions to use as a starting point:

- What is the urgent pain that your customers need to solve? Is it routine or existential?

- How do your customers find you — or you find them?

- How do they become interested?

- Who are the champions/evangelists of your product within the company? Is IT, the CFO, the marketing team, etc?

- How do they decide to engage?

- How do they select you and decide to buy? Who has to sign off?

- How do customers get live with the product? What are the typical expansion stages (250 users, 1,000 users, 10,000 users, etc)?

- What roadblocks must be overcome as they go live?

- Does your product expand by getting integrated with other workflows or support new use cases?

- How does the customer decide to renew?

- How do you become strategic to the customer’s business? What new problems are you solving for them?

Beating out the customer journey is hard. It requires distillation, conversation, and compromise. At times, it feels like a fight. But it’s absolutely essential that everyone has the same view of this journey, as it will drive the organization and produce key metrics.

Highlight 3 Key Milestones

Because the CJ stages represent the physics of the customer journey, no two companies will have the exact same CJ. That being said, we want to call out three important “milestones” that you should identify and highlight. (In our diagram, the 3 key milestones are overlaid over the top of the CJ stages). These are the most critical parts of the playbook, and will become important leverage points when you operationalize GTM. Make sure you can identify them in the CJ:

- The Urgent Pain. This is the pain point that drives the customer to buy now — not one year from now. (See “Find the Urgent Pain.”) Without the urgent pain, there is no GTM Fit.

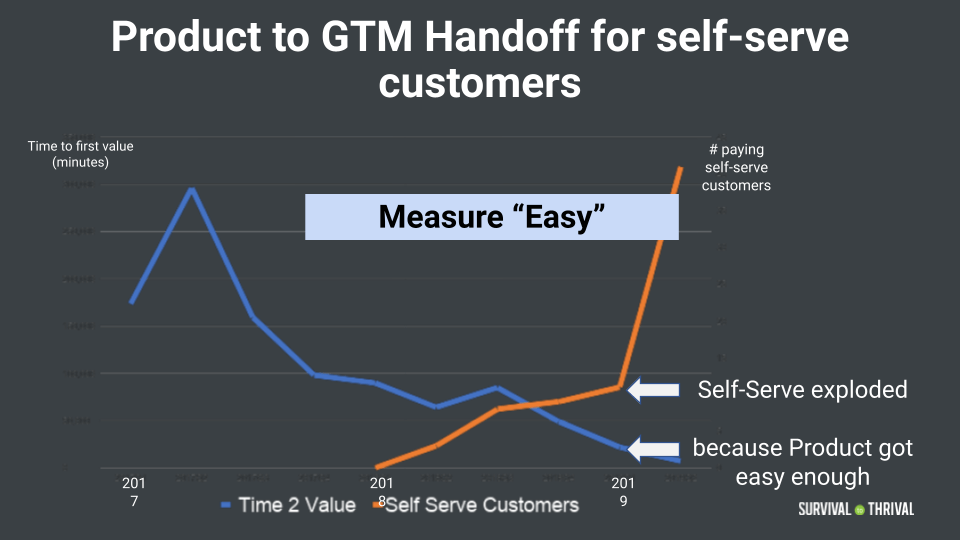

- Time to First Value. This is the first point at which the customer gets value from your product. Shortening time to 1st value can dramatically increase and/or speed up conversion. So, make sure you identify: What is the first value? When does the customer experience it?

- Become Strategic Platform. If your product solves an urgent pain for the ICP, your foot is firmly in the door. But how do you pry the door all the way open, and keep it open in spite of competition from others who can solve the urgent pain? The answer is to make your product “strategic.” A strategic product has a long-term value proposition. It becomes a platform embedded in the workflow that people build off of. How can your product become a strategic platform for the customer? If you don’t know yet, that’s fine. We’ll discuss “How to Become Strategic” in the next section. Once you’ve read it, come back to the CJ and figure out how your product can be strategic.

GTM TIP

Time to 1st Value Can Differentiate SLG and PLG

Pay attention to the first time the customer receives value from the product. Is it before or after the contract is signed? If it’s afterward, you’re most likely to follow a more traditional sales-led GTM model. If the customer receives value before the first contract, through a freemium service for example, you’re probably a better fit for product-led growth (PLG).

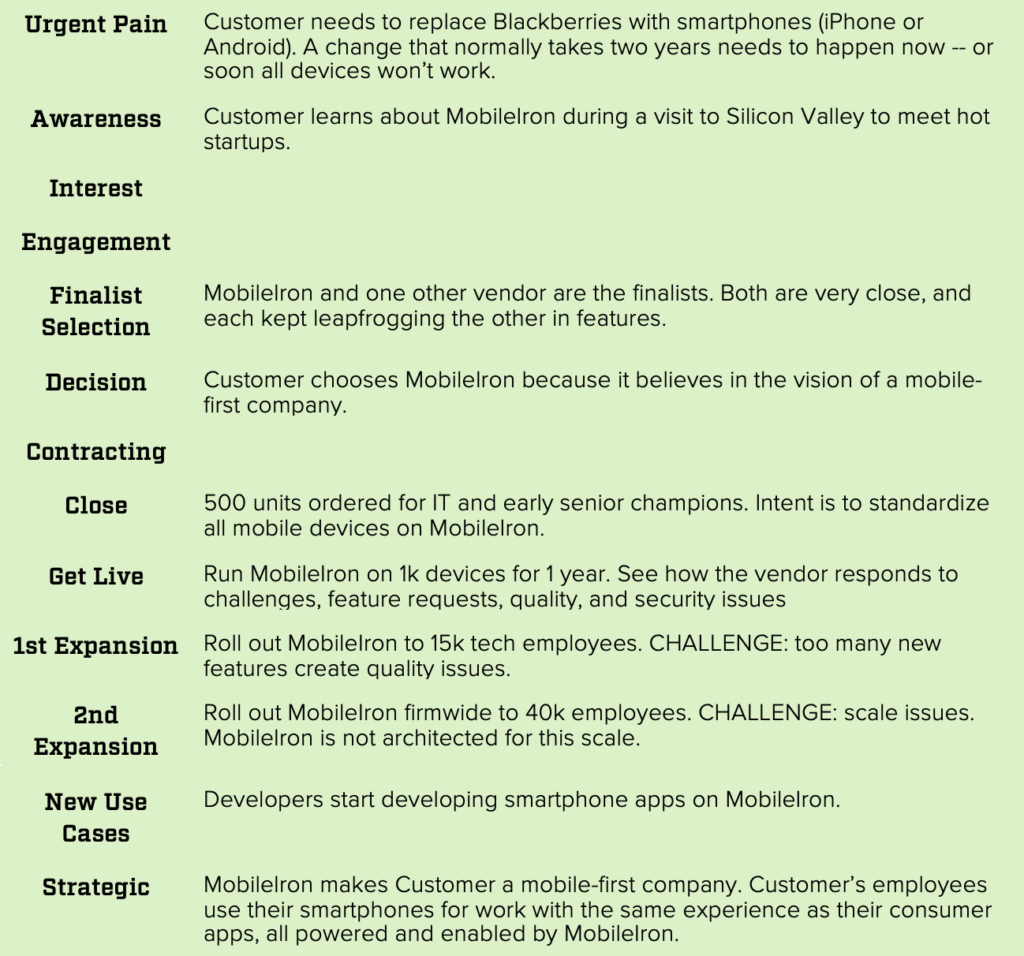

Sales-Led Growth Example: MobileIron CJ at Major Customer

Here were the steps of MobileIron’s CJ at a major customer, from urgent pain to strategic platform:

Examples: CJ Spreadsheet

The S2T Customer Journey & Playbook Spreadsheet also includes sample customer journey stages. Feel free to make a copy and adapt it to your company’s own CJ!

Challenges and Common Mistakes

Challenge Box

A shared view of the customer journey is harder than you think.

Consider the parable of the blind men and the elephant. Three blind men have never come across an elephant before. As an experiment, someone asks them to touch an elephant and describe what it looks like. So each blind man takes his turn and touches the elephant — but they all touch a different part of the elephant’s body! The result? The three blind men have a different idea of what an elephant is.

While the startup’s leadership team is most certainly not blind, they look at each part of the Customer Journey through their lens and from their perspective. That’s only natural. Try this: Ask the leader of each team to write down their view of the Customer Journey. Probably, leaders are mostly on the same page for the GTM playbook, but they have a 20% different view. 20% different means 80% the same, right? Unfortunately not. The 20% on which the four leaders differ is actually a different 20%. That means 0.8 same x 0.8 same x 0.8 same x 0.8 same = .41 same. That means that, to the rest of the company trying to execute the startup’s GTM plan, the leadership team is only 41% aligned and nearly 60% misaligned on the GTM playbook, making it almost impossible to achieve GTM Fit.

How can one build a repeatable GTM playbook if the different parts of the company don’t have a shared view of the Customer Journey? Force these views to converge. It’s critical. The team must have the same view of the Customer Journey. It’s the backbone of the GTM playbook.

Common Mistake

The CJ Doesn’t End When the Deal Closes

For SaaS companies, the CJ doesn’t end when the deal closes. In fact, that’s when some of the hardest work begins.

JJ Juergensen: “The customer-vendor relationship is like any relationship. Everyone’s happy at the beginning. When you start having problems, when it’s tested, that’s when the strength of the relationship shows — or not.”

Bob: “When we operationalized MobileIron at JJ’s firm, there were a few times I got a call from JJ about a problem with the rollout, and I almost had a mini heart attack. Those were do-or-die moments. We had to fix it — or else. And we did!”For a major deal, getting the customer live won’t happen overnight. Usually, there are several stages of rollout, and each presents challenges that must be overcome. The startup must be responsive to the customer and solve these problems as soon as possible. Failure to do so can mean you’re dead in the water, but responding well to problems will build trust and support expansion, upsell, and new use cases.

Common Mistake

The Customer is Not the Entire Company

Your customers are individuals within the company. There will always be competing voices and interests in a sales process, so make sure you find a champion within the company whose pain point can be solved by your product.

Common Mistake

Don’t Be Too Responsive to Customer Requests

It’s always good to listen to the customer. But be careful not to listen too much and waste time on trivial requests. You’re likely to meet with a few prospects who tell you they want to buy your product, but only if you add one certain feature for them. Should you do it? If it’s a request you hear over and over, it’s probably worth your time to add this functionality. But it’s a waste of your time to add a different feature for every customer, because it will spread your product team too thin — and probably lead to low-quality code that will cause problems later on. Save your energy for the big roadblocks and customer requests that will come up during the implementation phases. How you respond after they sign a contract will make or break your success.

How to Win First Customers

Up to this point, we’ve talked about the “what” of the CJ. Now, it’s worth pausing for a moment to talk about the “how.” Namely, how do you get your first customers? As we’ve already discussed, the urgent pain is hugely important to winning customers. But in the early days of a startup, the urgent pain itself may not be enough. That’s because there is a “risk asymmetry” between the upside of your product and the potential downside of working with an untested startup. In this section, we’ll explain what risk asymmetry is, and how to break it to win first customers.

Risk Asymmetry

Early adopter customers — and granted, they are rare — will seek out early startups to work with because the partnership gives them leverage to shape the product to solve their urgent pain. While most customers won’t engage until you’ve already found GTM Fit, these early customers see your GTM Fit before your team does. They see the startup’s strategic value.

Ashwin Ballal, who championed MobileIron in the early days, is one such early adopter. He says his empathy for entrepreneurs comes from childhood, watching both his parents build companies in India. When his company faces an urgent pain, Ashwin regularly seeks out startups to partner with. Usually, those startups — including MobileIron, Moveworks, FireEye, and Delphix — tend to be very successful in the long term. In fact, Ashwin says that when he’s bet on a startup, he’s never lost.

However, early adopters like Ashwin are rare, and most customers view things much differently. To the average customer, the risk of partnering with a startup can seem higher than the potential upside. And these are the majority of the customers that you will have to win over.

Put yourself in their shoes. What does your customer stand to gain if your product works, and what does he or she stand to lose if it doesn’t? While founding CEOs are usually focused on the former, most customers are focused on the latter.

Founding CEOs start companies because they have a positive vision of the future in which their product changes the game. When customers adopt the product, it not only makes a positive impact on the company: it turns the product’s champions into the company’s heroes. But it’s important to understand that your customers will have the exact opposite mindset. When they evaluate your product, they aren’t thinking I hope this gets me promoted. They’re thinking I hope this works and doesn’t get me fired.

“In vendor selection, there is more downside risk than upside.”

–JJ Juergensen, MD of Cyber Risk, Barclays. Former MD of IT, Morgan Stanley.

Think about it this way: You identify new technology that works well, convince your boss to sign a contract, get it operational. There are no fatal glitches, and everything ends up working fine. You’ve made an incremental improvement in your company’s workflow. Result? Your boss is pleased. Do people know that you’re responsible for the upgrade? Maybe not.

Say you make a good vendor choice twice. Three times. That’s how you build a reputation for making good choices. You’ll receive praise, and probably get promoted. Sounds pretty good!

But what happens if you screw it up even once?

Your ass is grass.

“When we made the decision to adopt MobileIron at my company [a major investment bank], the stakes were high. The product had to work. If there was even one small blip on the trading desks, it would have been curtains.”

-JJ Juergensen, MD of Cyber Risk, Barclays. Former MD of IT, Morgan Stanley.

No one seems to remember who’s responsible for positive improvements, but somehow they always remember who royally mucked it up. If you convince your boss to invest in new backup technology, then you’re hit by ransomware and your backup doesn’t work? Well, then you’re going to be the person everyone talks about ten years later over beers. Poor Susan, if only she hadn’t convinced the boss to spend $4 million on that software, she wouldn’t have been transferred to a basement in Kalamazoo…

To win early customers, the startup must break risk asymmetry and prove they offer more upside than risk.

Break Risk Asymmetry to Get Early Customers

Both early adopters and normal customers are looking for something in common: a product that breaks risk asymmetry and provides a game-changing upside. Startups that break asymmetry usually share the following three characteristics. While #1 is essential to win customers in general, #2 and #3 are especially important for winning early adopters.

#1 The product addresses an urgent pain — and is easy to use.

Many companies win first customers by solving an urgent pain in an easy and intuitive way.

When Ashwin started as CIO of Medallia, he had 26 employees reporting to him — and 25 of them were doing customer support. The startup Moveworks, which provides AI customer support services, had the potential to drastically cut costs. In other words, Moveworks solved a very urgent pain with a huge potential payoff that attracted the attention of Medallia’s decision-makers. We talked at length about the urgent pain — and how to find it — in a previous section.

If the product’s too complicated to understand or clunky to implement, it may not matter that it solves an urgent pain. Making your product easy — to try, to buy, and to use — is a powerful way to attract customers in an organic, bottom-up way. You can read more about the “power of easy” from our interview with Jay Fulcher, coming soon.

Solving an urgent pain in an easy and intuitive way is critical to win customers. But to win early adopter customers like Ashwin, startups need two additional characteristics:

#2 Personal Commitment

Buying from an early stage startup is a risky proposition. That’s why the personal commitment of the founder and leadership team can go a long way to reassure potential customers. Early customers have the power to make or break the startup’s trajectory, and when the founder shows a personal commitment to those customers, it reassures them that their investment is worth as much to the founder as it does to them. You’re committed to not making them a fool. In fact, this is the core reason why Ashwin feels comfortable — and even prefers — to work with startups.

“When I come early as a customer, I do take some risk — but for me it’s a lower risk in some ways. That’s because if I get a commitment from the senior management, I know they’re not going to let me down. It’s a symbiotic relationship: we win together or we lose together.”

Ashwin Ballal, EVP & CIO, Medallia

The relationship between founders and early customers like like a marriage. Founders can show this commitment through regular open communication and transparency with their early customers. If something goes wrong, let the customer know, share a plan to fix it, and whatever happens, you’re going to deliver on your promises.

Common Mistake

Overpromise, No Follow-Through

“Too often I see founders overpromise and underdeliver. Instead of saying yes to every request, it’s better to be transparent and set realistic expectations of what’s possible. I’m well aware that you don’t have a lot of resources. All software is beta, it’s going to have some issues. As long as you’re upfront about a screw-up, it’s OK. We can move forward. But I tell every founder: it’s you that should be calling me. The moment I’m calling you, we’re over with.” – Ashwin Ballal

#3 Become Strategic — and Turn the Champion into a Hero

It’s hard to become strategic to a customer. Yet, every founding CEO believes their product is strategic. The truth is most products are a “Version 2.0”: an improvement that replaces an existing version 1.0 system. It does something your customer was already doing, but better. The challenge is that in the best case scenario, no one will notice a change from 1.0 to 2.0, unless the product fails.

A strategic product is something that people notice. It not only helps the customer solve the urgent pain, it has a long-term value proposition. Usually, it’s part of an increasingly important wave over time: digital transformation, cloud migration, mobile enterprise, or consumerization of IT. It opens up new possibilities that will have an impact on the company as it gets embedded in their workflow. When a product is strategic to the customer’s business, it becomes a platform, and people build things on top of it.

When competing for a new customer, there are probably other vendors that solve the urgent pain just as well. Offering a strategic product is what separates the best vendors from the rest of the pack. For example, MobileIron’s entry point pain was solving the urgent pain of secure smartphone email, BYOD, and getting apps. But its high-level strategic value was to enable the mobile workforce. Not only did MobileIron solve the problem of mobile security, it reframed the problem of How do I secure my devices? Instead, the question became How do you become a mobile-first company where smartphones become key devices for every employee? MobileIron answered the problem with a visionary long-term solution.

Sometimes a product is strategic because of the pain it solves. If the customer is facing an existential urgent pain that threatens their very survival, your product has the opportunity to save the company. However, most urgent pains are not existential. It’s up to you to make your product more than a 2.0. How can your product drive key business objectives for your customers and unlock long-term possibilities that would not be otherwise available? Finding the answer to this question is the key to becoming strategic and winning long-term customers.

“Whenever I partner with a startup, I assign someone from my organization to take the lead on the relationship. This champion knows that successfully deploying the new technology can change their career and get them promoted, which makes incentives line up very well for everyone to win.”

Ashwin Ballal

Like most things about startups, Ashwin understands the power of aligning incentives between the startup and its champion within the buyer. When a strategic product drives key business objectives, people notice. The champion who leads and deploys the strategic platform becomes a hero within their organization.

In part because of his work on integrating MobileIron into his company’s mobile platform, JJ was promoted to managing director, a 1 in 100 shot for any employee. How did that happen?

“The urgent pain that drew us to MobileIron was an existential threat. Our trusted platform — Blackberries — were going away. Our execs wanted to switch to iPhones, but we weren’t able to secure the devices. If we did nothing about it, in two years none of our tens of thousands of devices would work. Nothing clarifies the mind like knowing you’ll be hanged in the morning.”

-JJ Juergensen, MD of Cyber Risk, Barclays. Former MD of IT, Morgan Stanley.

Clearly the downside risk of not solving this problem was huge. But what broke the asymmetry and made the upside so big? The answer lies in MobileIron’s ability to tie the urgent pain to a strategic destination. To see how that worked, let’s take a step back.

At the time, there were two general approaches to solving the problem posed by securing new mobile platforms. The first was the container approach, in which all the apps on your phone are put into a secure “container.” It was a trusted, familiar model. But the downside was that the user would lose the native Apple iPhone experience, and could only use applications that were specifically made for the container. Users would still be using a Blackberry app — on their iPhones.

The newer, untested approach was to leverage the native Apple platforms through their APIs. It meant retaining the “real” iPhone experience, allowing developers to securely develop apps on the iPhone. But it was riskier, since it relied on new platforms like iOS. For a firm like JJ’s, the downside risk of a data breach was catastrophic. So which approach did they choose?

“When we were down to the final decision between two vendors to handle mobile security, both of them solved the security problem equally well. The difference was that MobileIron’s solution relied on native platforms, while the other vendor took a “container-based” approach to security. We ended up choosing MobileIron because they had a clearer vision of where they were going. They saw that in the long term, execs would want their business devices to work exactly like their personal ones. A container-based approach would quickly become clunky and obsolete. And that’s exactly what happened.”

-JJ Juergensen, MD of Cyber Risk, Barclays. Former MD of IT, Morgan Stanley.

Your goal should be to make your product strategic to your customers and turn your champion into a hero. But you need a way in the door. Your way in? Line up with the urgent pain.

Special thanks to JJ and Ashwin for all of their help on this section.

End the CJ by Becoming Strategic

Let’s talk about the end of the Customer Journey. The CJ doesn’t end with closing a deal. Ideally, it ends with your product becoming strategic to the customer and turning your champion into a hero. Here are a few pieces of advice on how to accomplish that:

Find the Hero Report

If your product has the potential to be transformational to an organization, you can help turn your champion into a hero — and a happy reference customer — by helping them create the “hero report.”

The end of the customer journey is when your champion becomes the hero of their organization. Help your champion create a “hero report” — a dossier of all they have accomplished using your product, something that they can present to executives that gets attention and gets them promoted. Your best users may have created the hero report already. Go find it. Then share it.

“I am perpetually surprised that companies don’t do this [make the hero report] for potential reference accounts every single time. It’s such an easy way to nudge a sponsor from simply happy to proactively driving your offerings.”

-JJ Juergensen

Market Revolution, Sell Evolution

When educating prospects on your solution to their urgent pain, be mindful of their risk asymmetry. The key is to enlighten them about your product’s strategic potential (the upside) while minimizing risks to them (the downside). In other words, market revolution — but sell evolution.

Startups can become thought leaders by attacking the conventional wisdom of incumbents — the old dinosaurs that are big but dated. Your startup is the unicorn, poised to charge and disrupt. Attack with thought leadership and create a passionate community around the strategic destination promised in your founding idea. Make it provocative, controversial, and ideologically pure.

“At Marketo, a marketing SaaS company I invested in, our customer champions were early leaders in the new field of “demand generation.” Pretty soon, CEOs were asking for marketing leaders who had experience with demand generation. Building a community around your ideas creates a “flywheel effect” — a virtuous cycle that turns success into leads.”

-Tae Hea

But most customers are not so revolutionary. They want support from the rest of the organization. They do not want to assume career risk and huge uncertainty. These customers, despite being a firm believer in the revolution, prefer an evolutionary approach. Help these customers by selling evolution, where each step delivers value to the customer to build confidence and overcome organizational resistance. This approach doesn’t place the champion at career risk.

Read More

Check out Tae Hea’s blog post, “Attacking with Thought Leadership.”

Don’t Educate on the Urgent Pain. Educate on the Strategic Possibilities

Once you hone in on the urgent pain that your product solves, you don’t need to spend a lot of time “informing” new customers about the problem. They already know it exists!

“Sometimes a vendor will spend over 50% of our meeting talking about the problem in the market. But I’m already very aware of that problem. I live that problem! I want to know about the solution.”

-JJ Juergensen

Instead, educate your prospects about the strategic possibilities: the new implications and actions your product makes available to them. How can you help them understand the problem in a new way and provide a solution that will open up new opportunities?

“The best vendors help you think and talk about a problem space internally in a way that didn’t occur to you before. They know where the puck is going, and what the different possible outcomes will be. They know problems they can solve for you not only now but in the future.

Another one of our vendors, Tanium, got our attention by changing the way we thought about a relatively sleepy space: systems management. They asked us: ‘How would your life be different if you could query every machine in your system to see if it’s running the current patch level of an OS — and get the answer in 3 seconds?’ That made us sit up — and think about problems and possibilities differently.”

-JJ Juergensen

The magic is laying out the journey from urgent pain to strategic outcome.

#2 Build the Right Surfboard: Create a Repeatable GTM Playbook

Once you’ve found the urgent pain for your ICP and understand the customer journey, how do you repeatedly find and win ICP’s that have the urgent pain? This is where the Go-To-Market Playbook comes in.

“When designing a board, I create [it] to fit the surfer and the wave… going for the ultimate surfing experience.”

–Jeff Clark, Mavericks Surf Company

Like a surfer’s surfboard, the GTM playbook should match the surfer (your team) and the wave (your customer journey). It allows the surfer to catch the urgent pain and ride the wave to growth.

The GTM playbook is a step-by-step, repeatable recipe to find and win deals over and over again. It becomes the blueprint for your marketing and sales teams. It becomes the bible for every new sales or marketing person to ramp. It becomes a powerful tool to align the rest of the team behind a go-to-market plan. The GTM playbook is the backbone for repeatable GTM that is the core of GTM Fit and unlocking growth. It’s that important.

What does the GTM Playbook look like?

Let’s talk about what the GTM Playbook is not.

- The GTM Playbook isn’t just a better PowerPoint pitch.

Many founders translate “GTM Playbook” into “I need a better PowerPoint.” The playbook is not a PowerPoint deck. Bob: “I learned the magic of the GTM Playbook from MobileIron’s early VP Sales, John Donnelly. The first thing John did when he joined MobileIron was to take our fledgling Playbook 0.5 and make it a real Playbook 1.0. I made the mistake of thinking this was just a sales-pitch thing. Boy, was I wrong. The playbook gathers and distills all sorts of things: value propositions, sales processes, customer engagement, and what everyone in the company needs to do to find and win customers. Playbook 1.0 became the core operating system for our go-to-market strategy and helped everybody in the company line up behind it. Nailing Playbook 1.0 played a key role in catalyzing the acceleration of our business in 2010.” - The GTM Playbook is not a “brain dump.”

The GTM playbook is not a thirty-page braindump of everything a sales or marketing person should know. Instead of documenting everything that could be done, the playbook is about capturing the 3-4 key things we do to find and win customers at each step of the process. That distillation often requires a painful sacrifice of perfectly good ideas that are not essential to the process. - The Playbook is not Playbooks, plural.

Finding GTM Fit requires the startup to choose just one GTM playbook. It’s just too hard to execute on multiple GTM playbooks as an early stage company trying to unlock growth.

What does a GTM playbook look like? The GTM playbook is a recipe to find and win customers over and over again. It has three main components:

- Customer Journey Stages: From urgent pain, to initial engagement, to win, to hero.

- GTM Actions (for each stage): What’s done/said? Who’s involved? Exit criteria?

- GTM Deliverables (for each stage): What does the rest of the company do/build to support that stage of the playbook?

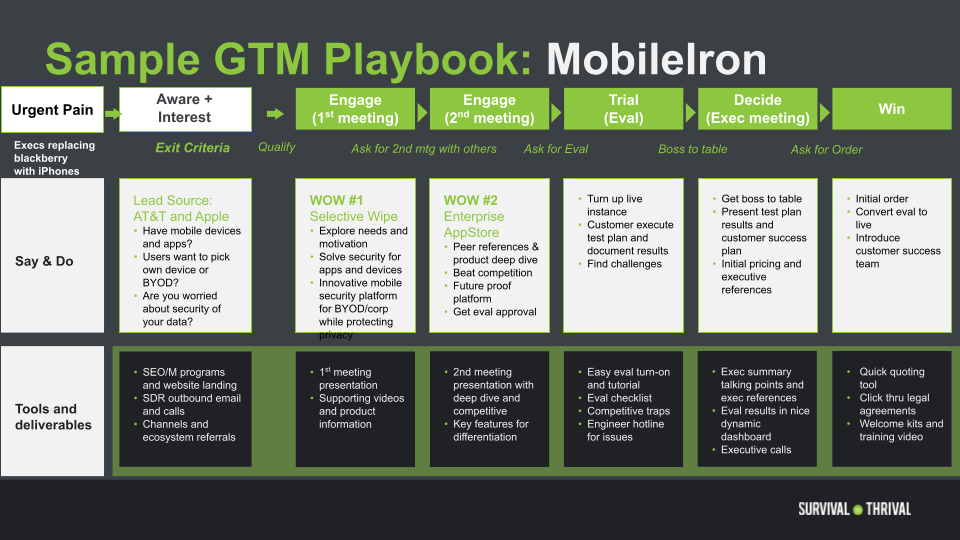

Playbook 1.0 has to be simple. If the playbook diagram doesn’t fit on one to two pages, it’s not ready. Getting there is harder than it sounds. It takes distillation, sacrifice, and constant iteration on the ground with sales and marketing reps. Below is a sample GTM playbook:

How do you know you’re on the right track? A good sign is when new employees tape the GTM Playbook up on their wall. A spectacular sign is when the leadership team and entire company adopt the language and the framework of the GTM playbook to talk about the business.

How does the GTM playbook evolve over time? For most enterprise startups at any stage, crystalizing the GTM playbook for new customers is the highest priority. Once established, metrics are key to iterate and improve on the playbook. Once GTM Playbook 1.0 is nailed, the process to develop a GTM playbook is very repeatable and extensible. Startups often create additional GTM playbooks for upselling customers, renewing customers, new markets, and even bringing new products to market. Building GTM playbooks becomes a core differentiator and execution expertise for the startups that want to build a fearsome go-to-market machine.

So how do you create a Playbook 1.0? Take the following steps, and then iterate, iterate, iterate.

Seed the GTM Playbook: Learn from “Davy Crockett”

The early stages of an enterprise startup are like the Wild West. In the beginning, there is no GTM playbook. The founder, and maybe an early sales or growth marketing person, are the rugged pioneers. They experiment to find the path through the woods to find customers and win deals, each in their own way. They are the “Davy Crocketts.”

Through a lot of hard work and a dose of luck, one of them eventually finds what seems to be a repeatable path through the woods to find and win customers. This is a big accomplishment. Their self-found map is the “seed” of your GTM playbook. Write it down.

“During early sales calls we had a whiteboard outside one of the cubes that said ‘What worked’ on the right and ‘What didn’t work’ on the left. We took notes on what kept a customer on the phone, what got to a second meeting, what caused a customer to invest time, and what caused them to move forward. And soon a funny thing happened: other parts of the company started paying attention to that list. It influenced our marketing slides. When we hired new salespeople, we used it as our starting point in teaching them. We didn’t realize it, but those notes were our first draft of our GTM Playbook.”

-Bob

Davy Crockett’s map is a great rough draft, but it’s going to take more massaging. The playbook needs to be understandable, repeatable, and executable by the newest sales rep. It’s a concise recipe for conversions that are repeatable, and thus scalable and predictable. Refining that playbook means locking the team in a room — again.

GTM Tip

Evolution from “Hands-on”: Automating Parts of the Playbook

In the beginning when direct experimentation is high, most startups begin with a manual, hands-on approach for each stage in the playbook. While modern sales and marketing tools can highly automate parts of a GTM playbook, it’s often expensive to automate until you know what is to be automated. But once you figure out what works, automation can make your GTM more efficient in the long run. For example, in the beginning, early customer sales engagement is hands-on with scripts; later, it can be automated using marketing tools. Early marketing engagement processes can also be automated by being built into self-serve, product-led processes.

Challenge Box

What if Davy Crockett is the founder?

If the founder was the Davy Crockett who found the early path, there is a special trap to watch for. It’s a classic mistake to hire new reps and tell them “do what the founder does.” The GTM playbook must be executable by a mere mortal sales rep or growth marketer — not just a founder who has the “founder pixie dust” and gravitas that can open special doors, get special meetings, and make promises.

Challenge Box

Should your first VP Sales be Davy Crockett or Braveheart?

During the search for GTM Fit, one of the classic and most important questions is: When to hire a VP Sales? Conventional answer: When it’s time to start selling. Our answer: We generally disagree, for two reasons: (1) No grade-A VP Sales will be the first salesperson in the door, and (2) grade-A VP Sales don’t author playbooks from scratch—they finish and scale them.

The better early path to GTM Fit is to hire Davy Crockett–style salespeople who can “find the path through the woods” by iterating and experimenting on sales to find and win early customers. The Davy Crockett-style sales rep develops early versions of the Playbook and gets the company close to GTM Fit. A Davy Crockett-style sales rep is comfortable working with no map and insufficient supplies, and exploring the unknown. Most grade-A VP Sales will intuitively recognize the difference between PMF and GTM Fit and choose to wait for clear signals that the startup is close to GTM Fit. What’s the first thing a grade-A VP Sales candidate will want to do? Talk to early sales reps and early customers to see if there is a repeatable pattern that will scale!

Then, as the company gets closer to GTM Fit, it’s the right time to hire the VP Sales. An exciting startup on the cusp of GTM Fit becomes a very attractive opportunity for grade-A VP Sales. Once aboard, the newly hired VP Sales will polish the playbook, build an army, and then—like Mel Gibson in the movie Braveheart—lead the go-to-market army into battle against the enemy!”

GTM Actions: Who/Say/Do + Exit Criteria of Each Stage

What happens in each stage is the foundation of the repeatable sales playbook. Marketing knows what to do. Sales knows what to do. The playbook becomes a great teaching tool for onboarding new teams. But nailing all of the “say-and-do” stuff down is harder than it might seem. One company finished 50 percent of its playbook in three hours—but then took another three weeks to finish the remaining 50 percent! Distilling everything down to one or two pages forces focus and sacrifice.

This is where the CJ becomes very important. Under each stage of the journey, answer these questions:

- WHO: Who from the customer’s organization is involved?

- SAY/DO: What is said or done at each stage?

- EXIT CRITERIA: What are the exit criteria to advance to the next stage?

WHO: Remember, the customer is not the company. The customers are individuals within the company, and different individuals — and committees — are involved at each stage of the sales cycle. Who’s the champion? Is it someone from the IT department? Engineering? Does the champion have to get approval from higher-ups? Who makes the final decision to purchase?

SAY/DO: Try to get this down to 3-4 things per stage. What does marketing do to generate leads? What is the script for the first sales call? What do you say at the first meeting? The second meeting? What do you do during the eval? When do you get the boss to the table? How do you hand off to customer success?

EXIT CRITERIA: These vary based on the stage. Here are a few examples: Lead is qualified. Ask for a second meeting. Ask for an evaluation (eval). Bring the boss to the table. Ask for an order. Complete a contact. Sign the contract. Complete training and setup.

Everyone will have an opinion about what matters most. And everyone will have to sacrifice ideas or historical habits they cherish. The biggest debates will happen here. This is hard work and requires quality time, typically dedicated multi-hour blocks every couple days for several weeks. It is some of the most important GTM work that a startup team will do, which is again why the development of the playbook must be owned by the CEO.

Here is one example of Say/Do for a sales-led playbook:

Find the “Wows” and Identify Blockers

As you lay out your internal motion, keep an eye out for things that speed up or slow down deals: your Wows and Blockers.

What is a Wow? Every product or service that’s being sold has a “Wow!”—something in the pitch, the demo, the eval—that brings home the value proposition. A killer feature. A killer demo. A killer slide. A killer quote. Something that converts a moderate prospect into an energized opportunity, or from a trial customer into a champion for your product. A Wow is something that triggers an action from the customer and inspires them to move to the next stage of the journey. A Wow might prompt your customer to ask for more information, invite a colleague or boss, request a demo, or start a trial period. It nudges your customer to move to the next step of the customer journey.

How do you find the Wow? By listening to the customer. Here’s a typical situation: a founder is meeting with an early prospect, explaining the product and detailing this capability, that capability. The customer passively listens, until… they hear something that makes them sit up. Their body language changes. They lean in and say, “Tell more more about THAT.” That’s a potential Wow.

Who decides the Wow? Neither the founder, nor the sales person, nor the engineering team decides the Wow. The customer does. Listen to your prospects. Watch your prospects. Be warned: the Wow is often not the feature your engineering team is most proud of. Sometimes it’s a smaller function that is buried in your product — but is super interesting to the customer.

What do you do with a Wow? When you find the Wow, amplify it in pitches, build it into evals, and in some cases make changes to the product user interface to make it easier to find and demo. The Wow doesn’t have to be a major feature that’s frequently used in production by the customer. It just has to be a capability that causes the customer to engage and move forward in the GTM playbook.

Examples: Finding the Wow

- MobileIron. MobileIron discovered two Wows that made customers lean in and ask for more information: Selective Wipe and the Enterprise App Store. Selective Wipe was a feature that allowed IT departments to wipe work data from an employee’s phone without removing personal data. As employees started to bring their own devices to work, it used to mean losing all their music and pictures if they left their job. MobileIron found a way to selectively wipe work data — and made it easy to demo. The second Wow, the Enterprise App Store, was a private app store for companies where employees could get company apps. Though it wasn’t an important feature, it was an important part of the sales process. Customers saw they could have app stores for their employees — just like Apple’s.

- Talkdesk. TalkDesk found that their Wow was just how easy it was to use the product. They had simple, transparent pricing, signed short-term contracts, and we had a product that could be up and running in 24 hours. Put all together, adopting Talkdesk was a no-brainer, and low-risk compared to anyone else in the market.

- CloudKnox. CloudKnox, a cloud security company, addressed an urgent pain that automation had created for enterprise customers. For every customer, they found that there were 1-2 lines of code that could download or destroy all their cloud data, incurring huge regulatory risks. CloudKnox delivered a “Wow” by showing the customer which people in their organization had the nuclear keys to destroy all the data — in under 24 hours. That got customers to sit up.

- Vanta. Vanta helps small SaaS get through SOC 2 compliance, a certification that makes big companies feel comfortable using their services. The urgent pain was that SOC 2 compliance is confusing and expensive; it slows down and even deals. For prospects who had already gone through the painful compliance, Vaunta showed them how they could do it painlessly, with a dashboard that automatically updated every day.

Your Blockers are the opposite of your Wows — they’re what hold your prospects back from the next stage of the journey. Ask: What’s holding you back? What’s causing conversion to be slower? Common blockers include:

- missing features

- an execution issue

- a missing ROI analysis

- underwhelming demo

- onboarding is too hard

Blockers are NOT just “objection handling.” They can’t be solved by training the sales team better. They occur at all points along the playbook, and therefore must be addressed by the appropriate departments.For example, if your issue is the hurdle of the finance department, do an ROI analysis ahead of time, so your champion doesn’t have to.

Regardless of what your Blockers are, identify them and find a way to knock them out. Getting ahead of these problems will save time at crucial steps of your playbook.

GTM Deliverables for Each Stage

Under each stage of the playbook, clearly identify the tools and deliverables needed to support that stage in the playbook and move customers to the next. The list of tools become top priority deliverables for the team and becomes part of the muscle of the sales motion.

Defining the list also has a very beneficial side effect for the rest of the company: the cacophony of seemingly endless requests from the GTM team to the rest of the company now makes sense. The playbook becomes a very powerful way to line up the different aspects of an early stage company behind the GTM strategy. The playbook provides clarity and motivation to the rest of the company—engineering, product managers, marketing managers, support managers, and others—to see how the thing they are working on ties into the overall go-to-market plan for the business.

What kind of deliverables are on the list? Ask “What are the key things we need to nail this step in the playbook?” Typical deliverables include:

- sales tools

- marketing videos

- digital marketing SEO/SEM campaigns

- customer presentations

- key “Wow!” product features

- legal agreements

- evaluation guides

- onboarding guides

GTM Tip

Revise the PowerPoint to Match Davy Crockett’s Voiceover

Just as your pioneering Davy Crockett sales rep found their own personal path to find and win deals, they probably give their own effective presentation over the standard sales pitch deck. As you beat out the deliverables at every step of the playbook, it’s a good idea to revise the slides to match Davy Crockett’s “voiceover.”

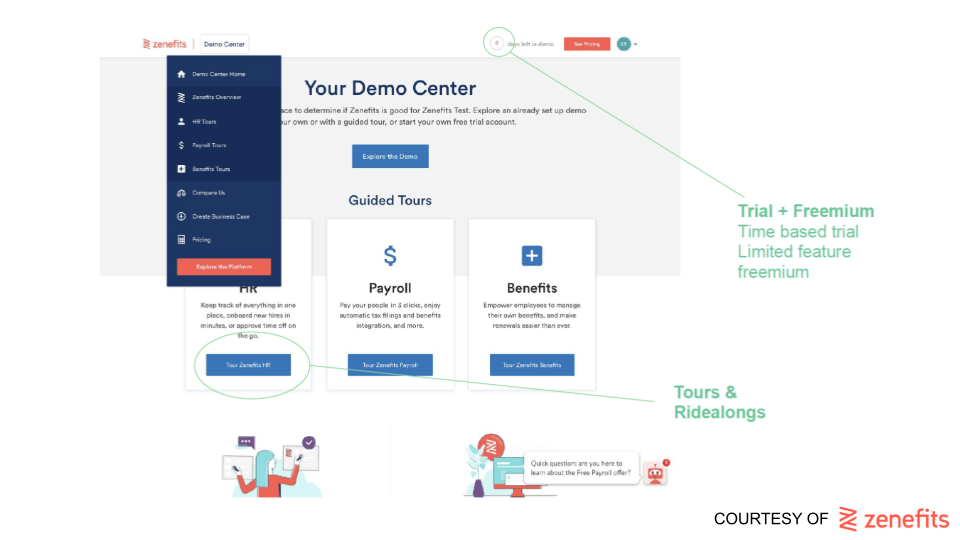

What is Product-Led Growth (PLG)?

While product-led, self-serve platforms like Dropbox or Zoom are more common for direct-to-consumer business, the product-led playbook is taking off right now in the B2B space. Because PLG delivers value to customers immediately, it builds trust through transparency and collapses the sales timeline.

What is product-led growth (PLG)? “Product-led growth is a bottom-up approach to go-to-market,” says Jay Fulcher, CEO of Zenefits. “It’s in contrast to the top-down approach that’s typical of a sales-led motion.” In the traditional GTM model, sales reps first approach the economic decision-makers of the company, who are not typically the end-user of the product. PLG is the reverse. Instead of talking to the top brass holding the purse strings, PLG starts with the user who will actually use the product, approaching them with a self-serve approach that allows them to explore and test the product before they buy.

PLG vs. SLG: Which to Use?

Which is better for your company: PLG or SLG approach? Pay close attention to how the customer “makes the decision to buy” as you’re winning early deals. Not the logistics of the decision, but the cognitive process for how a company engages with and buys your product.

- Committee decision? That’s usually best handled by a sales-led process. Oftentimes the customer champion is unfamiliar with how to build an internal consensus to approve the purchase. A good salesperson leads the customer through their decision and helps the customer champion build that internal consensus.

- User and Decider are two separate people? Marketing-led tends to work here. Much of the early engagement and selling can be done by marketing, and perhaps sales comes in at the end.

- User and Decider are the same person? If the product is reasonably well understood, a self-serve product-led approach GTM motion is often best.

As a general rule of thumb, PLG works best when first value occurs before, rather than after, signing the first contract. It’s also helpful when the economic buyer and the end user are the same person — or at least work closely together. These two conditions a little bit of chicken and egg, especially when you’re building your first GTM playbook. So it’s better to ask: is my product use case amenable to a first value before the contract? Is it amenable to a user that is close to, if not the same as, the buyer? If so, some or all of the elements of PLG will be useful for your GTM. In fact, the GTM playbook doesn’t have to be one or the other. In fact, many B2B startups will benefit from using a hybrid approach that uses PLG to land customers and SLG to expand those customers using the customers’ own data.

GTM Tip

PLG is great for selling to engineers

PLG is especially impactful for products aimed at software engineers — like Twilio or Stripe — where the end user’s experience of the product can greatly influence the evaluation and purchasing decision. If the engineering team builds your product into their workflow, no one’s going to take it out!

At the startup SendGrid, PLG started with the founders wanting to build software to make the lives of developers better and easier, and that meant minimizing time spent with salespeople. At Zenefits, Jay decided to implement a PLG playbook alongside the existing SLG playbook in order to capture small and mid-market customers. “Before PLG, we had great product-market fit,” says Jay. “And our market is the 32 million companies in the US with less than 500 employees.” But 32 million is a big number! “Our sales team just couldn’t deal with the level of organic demand in a cost effective manner. We couldn’t ignore the market, so we had to change.” PLG helped Zenefits meet that demand. “Our customers wanted to move much more quickly, be more educated and self-sufficient,” says Jay. “We built a PLG system to activate their ability to see in our technology the solutions they’re looking for.”

At the same time, the PLG system Jay’s team built accelerated upmarket deals, because sales reps could give decision-makers instant access to the product. “Our marketing team built a buying center to help accelerate larger deals and assist buyers with ROI, and business cases to make a clear competitive differentiation.”

What about a seed-stage company that just found PMF? Should they start with traditional sales and add PLG later? We don’t believe there’s a one-size-fits all GTM model. The playbook you build should be based on your product. And while a product-led approach helps to close deals for small and mid-market customers or small teams within large customers, sales and customer success reps should lead the way for upsells. For a company that is looking to win customers upmarket, a sales team will always be essential. That being said, Jay has a particularly optimistic view of PLG:

“I do have a very strong opinion on this subject. If you can, it’s ideal to start with PLG.” That’s because a sales-led model can get the company focused on the wrong things. In old-school sales, you’re looking at how to get the attention of the economic buyer, not solving the problem of product-market fit. You’re trying to take the customer by the heels, turn them upside down, and shake money from their pockets. The focus is on how to extract money from the buyer, rather than to deliver value to the user. If instead you build a product that delivers value to the user and a process that helps the user see that value, you now have a product that sells itself.”

–Jay Fulcher, CEO, Zenefits

Key to PLG: Make it EASY

Jay’s formula for PLG comes down to this mantra: “Make the product easy to try, easy to buy, easy to implement.” Achieving “easy” is easier said than done. But when it’s done correctly, the results speak for themselves. “The day we implemented a self-serve demo and checkout for the product, we had $250k more in revenue overnight,” says Jay. “It was stunning, and it showed us just how much demand there was downmarket. Now it’s over 20% of our business.”

Why is “easy” so powerful? “Customers don’t want demands placed on their time,” says Jay. “With PLG, customers can do the evaluation on their own time. There’s no sales pitch. No discovery process. They can actually touch and use the product instead of hearing about it from a sales rep.” When the customer drives the sales process, the transparency around the technology sells the product. As Jay says, “Customers feel like they’re getting helped, not sold.”

A good way to measure easy is time to first value. Shortening the time to first value can shorten the sales cycle from months to days — or even hours. Zenefits’ website delivers immediate value by allowing prospects to demo the product using their own company’s data and see for themselves how it works. “At times we’ve had a lot of customers in the demo stage waiting to ask clarifying questions before they buy,” says Jay. “Then our team moves to follow up, only to find they’re already under contract!” Never. Underestimate. Easy.

Sample Playbooks

Below is a comparison between common sales-led and product-led playbooks.

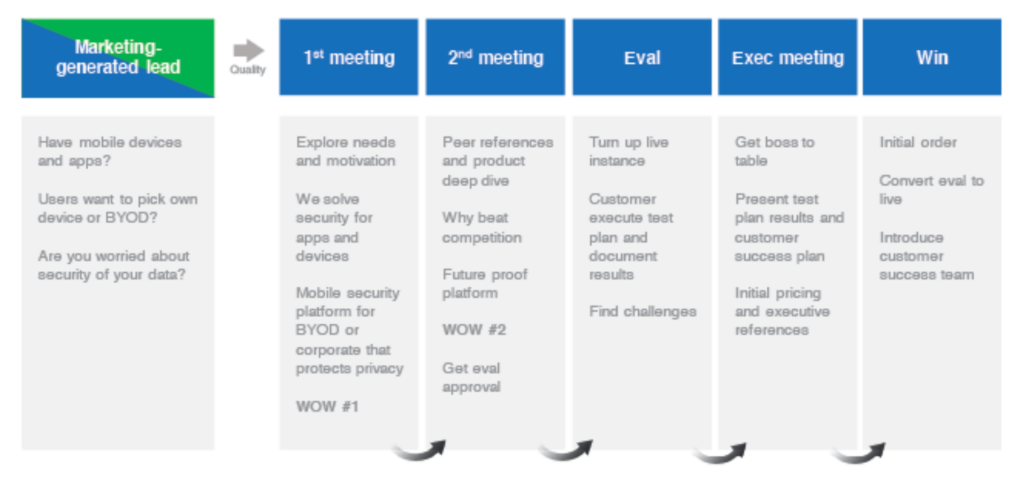

Example: Sales-Led Playbook, MobileIron

GTM Model: MobileIron followed a sales-led playbook where marketing generated leads and then handed off qualified leads to sales which then moved them through the sales stages.

Marketing: lead with the 2-3 story hooks to grab customers’ interest. Tools focused to drive leads and qualify them. Goal: convert leads to become 1st meetings.

1st Meeting: introductory call or webinar with simple messaging and education. Tools included presentations, simple videos, and the first Wow (show separation of work and personal data on a BYOD device). Goal: 2nd meeting for deep dive meeting with relevant parties.

2nd meeting: deep dive meeting with business and technical stakeholder. Prove value proposition, share long term vision, and provide peer references. If necessary, drill into competitive differentiators. Tools are more technical, plus the 2nd Wow (the “Enterprise App Store”). Goal: customer commitment to spend time on a product evaluation, which means customers get serious.

Evaluation: Customer live evaluation of product to prove value proposition and competitive superiority. The hard part: mobile was new; customers often didn’t know how to evaluate. Therefore, a critical tool was the evaluation checklist and test plan to help the customer, and of course highlight advantages. Evaluation checklist was a living document regularly updated due to new capabilities or competitive tactics. Goal: Ask for executive meeting to present results of test plan. The evaluation stage content was reverse-engineered to maximize impact of executive meeting.

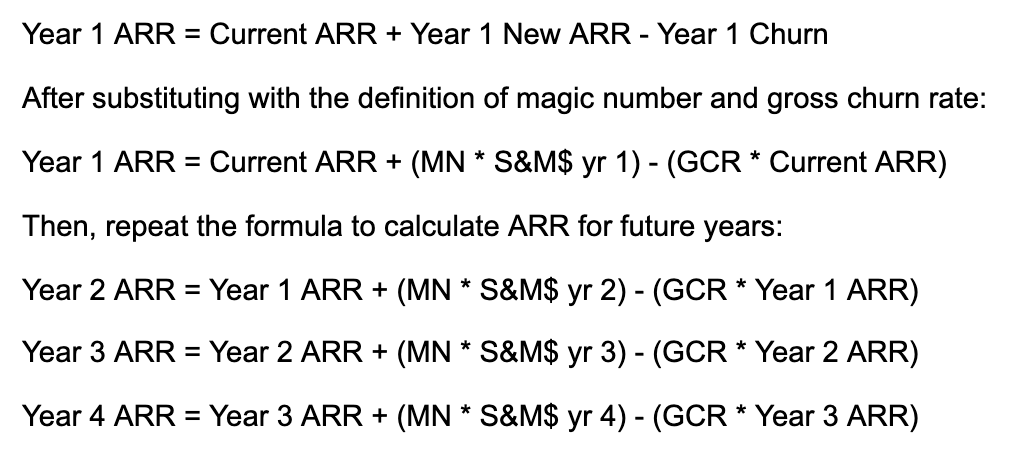

Executive meeting: Present successful evaluation report, share long-term vision of company, and discuss execution capabilities to ensure successful product rollout. Tools include evaluation report, executive presentation, and personal calls from CEO or other company leader. Goal: business approval to select MobileIron and buy.